CA Sales

15 January 2024 By PDSNETIn recent years, the JSE has not seen many high-quality, exciting companies listing on the exchange. One of those few is CA Sales Holdings (CAA), which offered both fund managers and private investors an excellent opportunity to make a significant capital gain last year.

CAA is a company which has grown out of supplying fast-moving consumer goods (FMCG) to Botswana. It also supplies goods to Eswatini (Swaziland), Namibia, South Africa, and a smattering of other African countries. Its business consists of taking on the warehousing and distribution of specific brands on behalf of manufacturers and then getting those brands into stores and then into supermarket trolleys – mainly in Southern Africa.

Looking at its financials for the six months to 30th June 2023, half of CAA’s revenue of R5,2bn originates in Botswana, 19,7% in Namibia, 14,5% in Eswatini and 13,7% in South Africa with 1,8% going to other nearby countries like Zambia, Zimbabwe, Mauritius, and Lesotho. Obviously, the cost of fuel is a major factor in this company since most of the products it handles are moved by truck.

In its maiden interim results for the six months to 30th June 2023 the company reported revenue up 22,5% and headline earnings per share (HEPS) up 21,5%. The growth was mostly organic, but the company has been making acquisitions. The group acquired the T&C Group which is a retail and distribution company in Namibia for R65m which resulted in a gain of R123,6m due to the increased market share in that country.

The group’s balance sheet is healthy with R590,4m in cash and non-current liabilities of only R327m with its finance income exceeding its finance costs. There is an intangible asset of R514,7m on the balance sheet which is the goodwill which has accumulated from making various acquisitions – but that is both expected and quite normal in a company like this since part of its growth comes from buying up successful retail and distribution businesses in various Southern African countries.

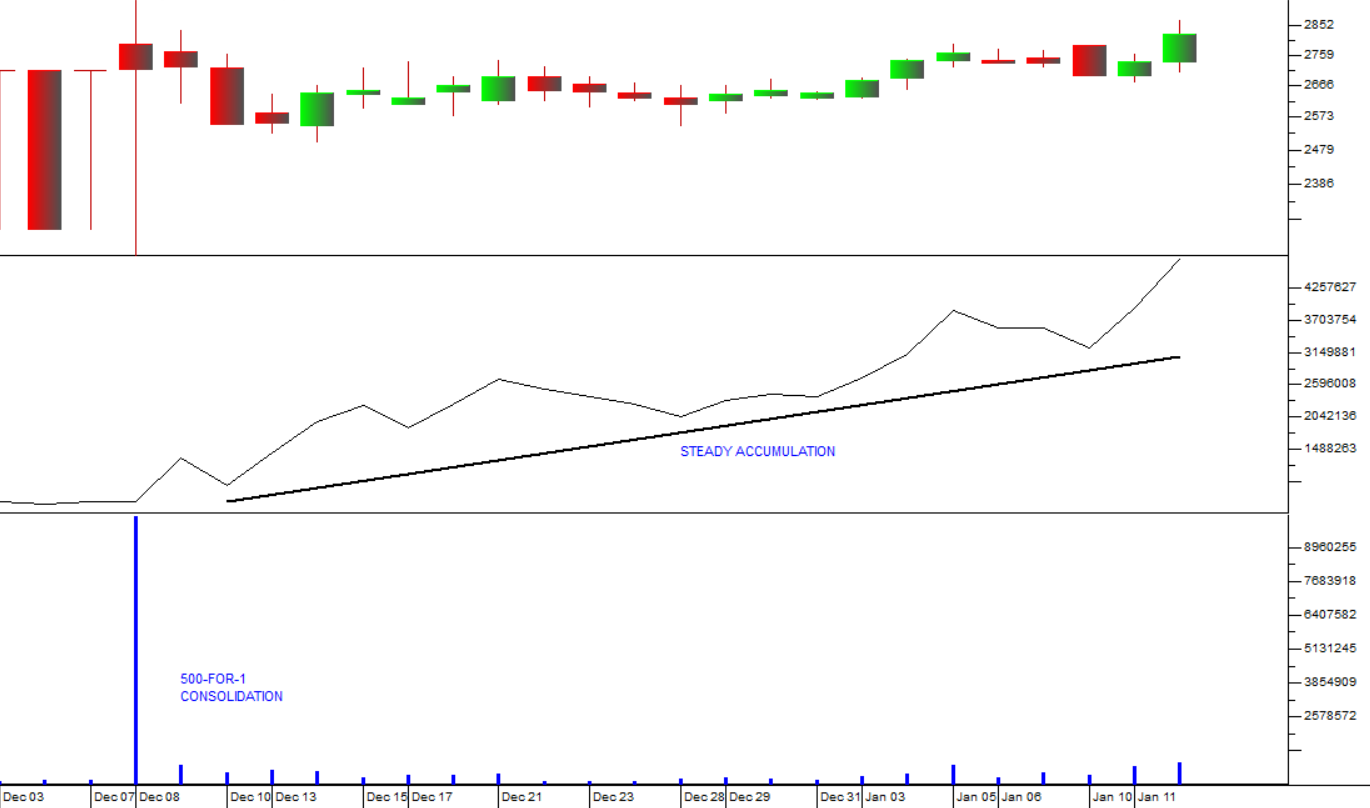

The company listed 475,4m shares on the JSE on 27th June 2022. After some initial excitement and some stagging, the share price settled into a steady upward trend in the last three months of 2022. Then for the first 8 months of 2023 it was moving sideways between 650c and 750c.

The break came on 25th August 2023 when the share broke up to 775c and it was added to the Winning Shares List (WSL) on that day. Since then, it has moved up to 1151c – a gain of 48,5% in under five months. Consider the chart:

Since October 2022, the company has been gaining acceptance among institutional fund managers as a high-quality, growing business. We expect that process to continue, and we expect the company to grow further as it expands its footprint with additional brands and a greater penetration of African markets.

Its business model has great potential given the difficulty that many FMCG companies, such as Pick n Pay, have had in establishing a presence in various African countries.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article:

.png)

.png)