Hyprop

Property shares on the JSE have had a torrid time over the last few years. It began with the melt-down which resulted from the Resilient crisis, now substantially behind us, and continued with the eventual failure of the Edcon Group and the effects of the COVID-19 lockdown. These events have combined with a generally negative economy to reduce the value of property shares significantly.

Hyprop

Market Overview

Now that the uncertainty of the US election is essentially over, it is perhaps a good time to step back and consider where we are and what is likely to happen next.

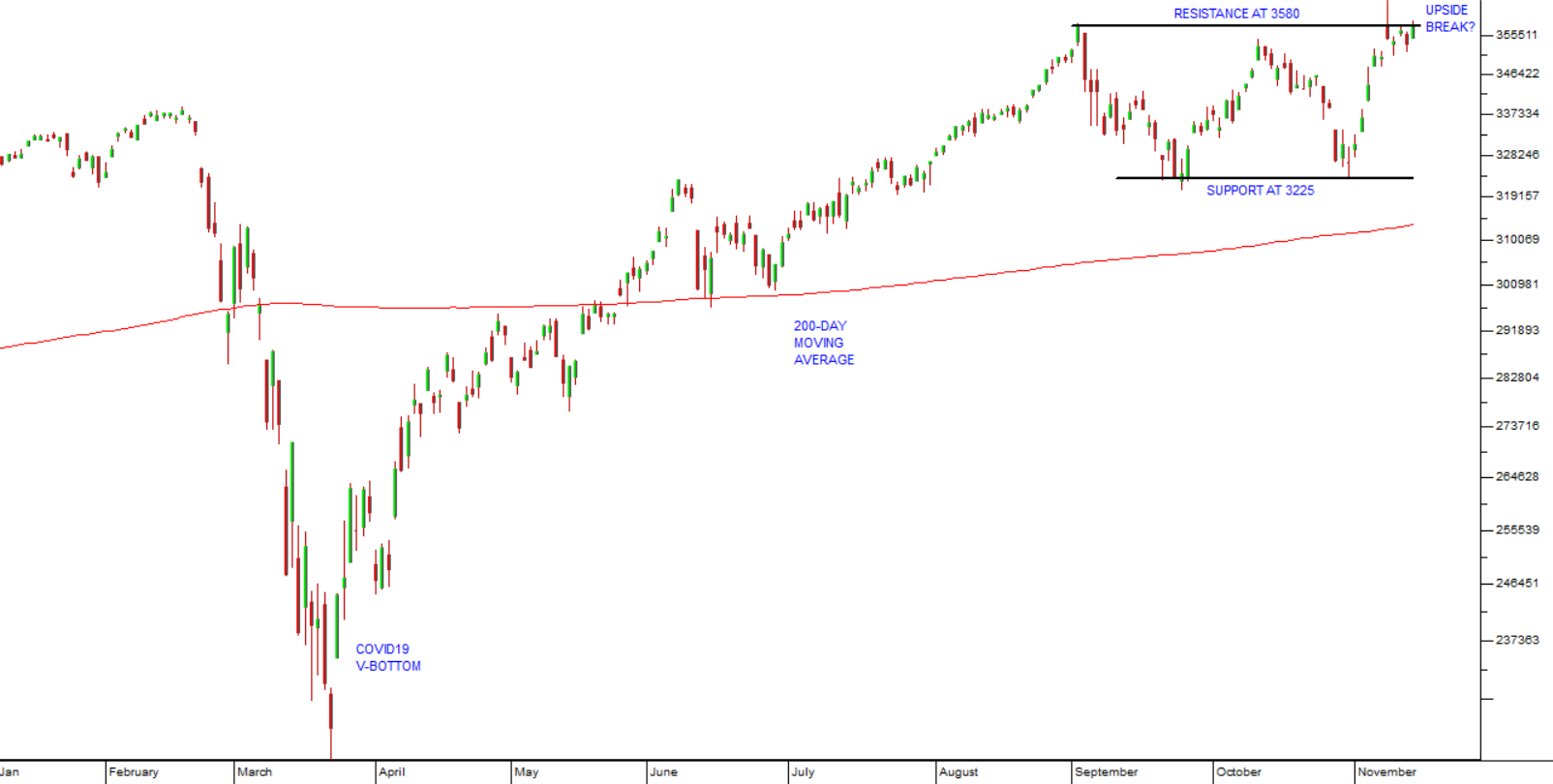

The S&P500 index, which is an excellent benchmark for trends in the international markets, appears to be breaking to a new record high – above the resistance at 3580. Consider the chart:

Insider Trading

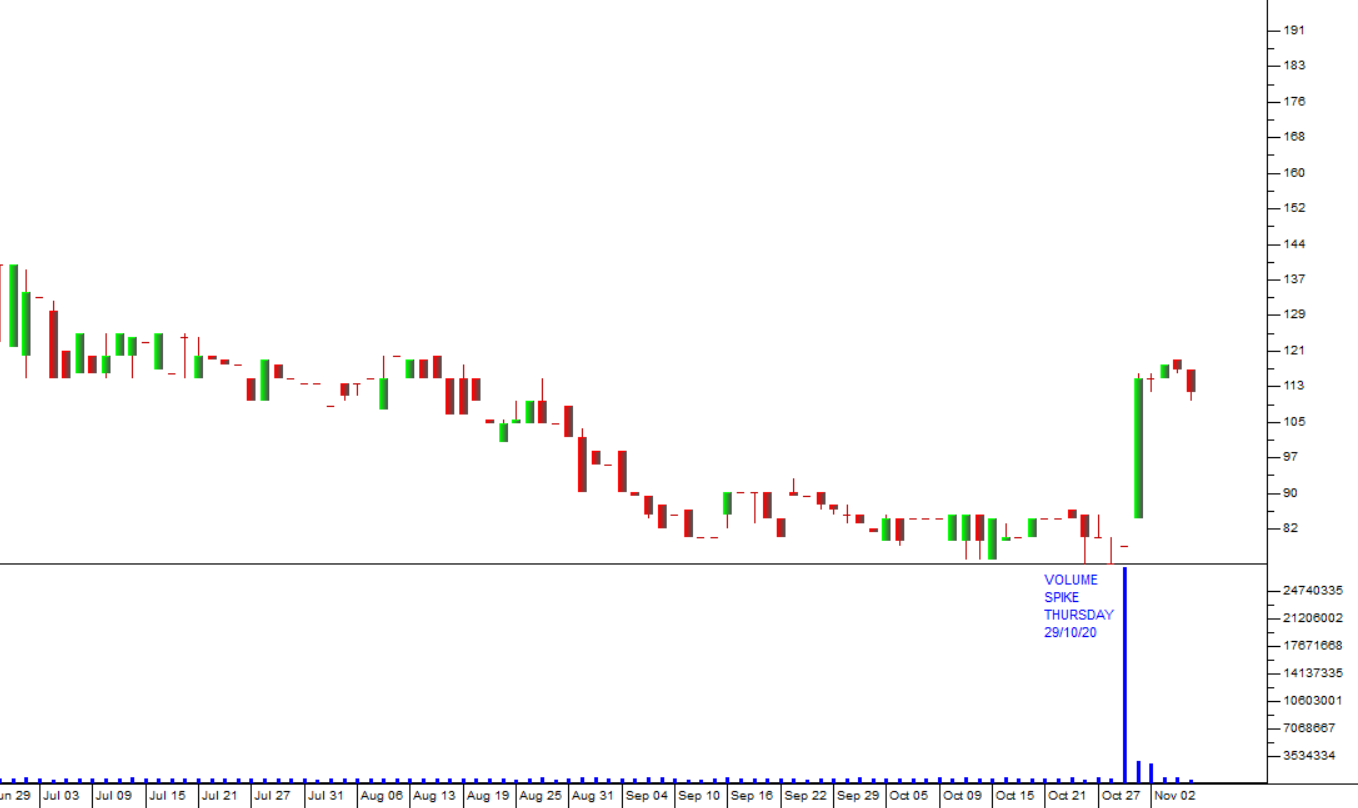

The JSE has just witnessed one of the most blatant examples of insider trading in many decades. It involved a small real estate investment trust (REIT) called Texton. This company owns 53 properties, 56% of which are in South Africa and the balance in the UK. After it listed on the JSE in August 2011, the share rose to a high of 1235c on 6th March 2015 before beginning a steady