Balwin

18 October 2020 By PDSNETThe JSE property index (J253) has fallen over 68% since December 2018, firstly because of the adverse report about the Resilience group in January 2018 and then because of the pandemic in March 2020. This has left the index trading at a fraction of its underlying value – which represents an opportunity for private investors.

Among the property shares there are some which we believe represent bargains, and one of those is Balwin.

Balwin is focused on developing secure sectional title properties close to the major centers in South Africa. Listed 5 years ago, the share has a net asset value (NAV) of 631c as of 31st August 2020. The current share price is 428c – so it is trading at a 32% discount to the net value of the properties which it owns. The company has shifted towards renting out properties for between R4500 and R8500 a month to generate income. This is a part of the rental market where there is strong demand, even after COVID-19, because many households have been downsizing into smaller, cheaper accommodation.

The company recently launched the R44bn Mooikloof Megacity development which is a public/private partnership aimed at South Africans earning between R3500 and R22000 a month. This type of development will ensure that the company has a steadily rising income for years to come.

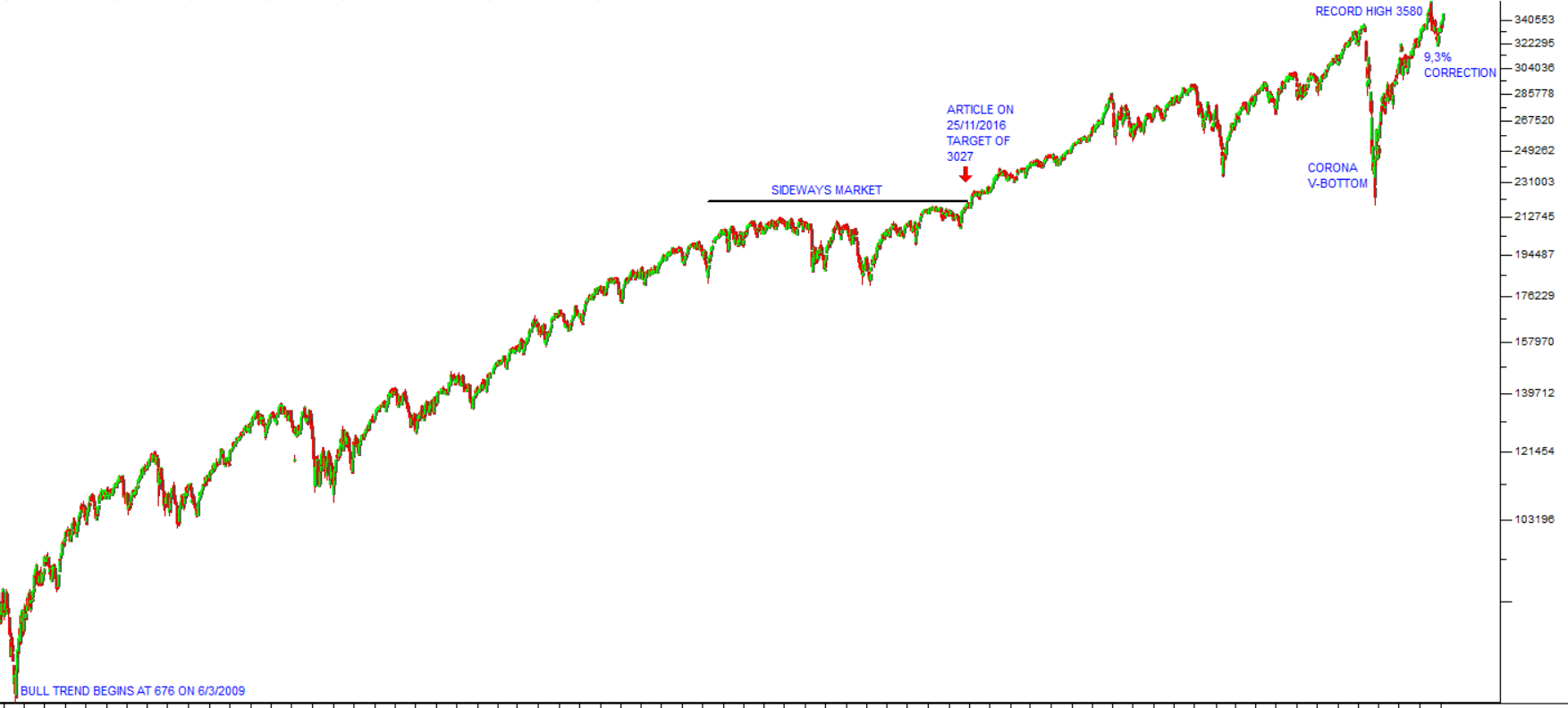

But perhaps the most attractive feature of this under-valued property counter is that its loan-to-value (LTV) is only 25%. This means that it is very under-geared compared to most real estate investment trusts (REIT) and has substantial headroom to make acquisitions and survive these tough times. Consider the chart:

Here you can see that since listing in October 2015, the share has been in a falling property market where property shares have generally gone out of fashion.

But, its recent results for the six months to 31st August 2020 have changed investor perceptions resulting in a clear upside breakout through its long-term downward trendline. We believe that this share will continue to perform well in the future and that it represents a really solid investment at current levels around 428c. The CEO, Steve Brookes, is planning to grow the company to have assets of over R10bn by 2025 and he is in a good position to do that because the balance sheet leaves room for acquisitions in a market where there are plenty of properties selling cheaply.

He also talks about increasing the company’s “free float” which will certainly make it more attractive to institutional investors. Over the six months to 31st August 2020 Balwin is one of the very few REITs to pay a dividend. And the dividend it is paying (19,6c) is a whopping 68% more than it paid in the previous year.

We feel that this share represents a low-risk high-value opportunity in the current market.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: