Rare Opportunity

9 March 2024 By PDSNETYou may not have been aware of it, but last week, between Monday and Friday, there was an opportunity to make an 80% profit on your capital. This opportunity occurred because of insider trading on a little known and traded share called Quantum Foods (QFH) in the poultry and animal feeds business.

Generally, the poultry business is not one which we would recommend to private investors. This is because it is very capital intensive, has high working capital requirements, has a large work force which exposes it to union action and it is subject to unpredictable events like the outbreak of avian flu.

But last week this otherwise uninspiring share gave investors a rare opportunity to profit from rampant insider trading. When an important corporate action like a takeover taking place within a listed company, there is inevitably a small group of people, with inside knowledge of exactly what is going on, who seek to profit it from it before the public at large is alerted. This is known as “insider trading”. It is illegal, abut from time to time there is a clear example on the JSE.

The last such event to our knowledge occurred in Hulamin (HLM) in the week of 11th to 15th October 2021. On that occasion, the astute private investor, without knowing exactly what was going on, could have made a profit of at least 66% in just one week. We covered that in our article “Insider Trading” published on 18th October 2021.

The point is that this type of insider trading is eminently visible in the share's volume traded. The insiders inevitably seek to profit from their special knowledge, usually indirectly through a friend or relation that cannot easily be traced back them, by buying up as much of the share as they possibly can before the important facts are made public. This buying activity causes a massive spike in the share’s volume traded, accompanied by small increments in the price.

So, the pattern of events looks like this:

- The share is trading at low volumes with almost no changes in price for months or even years.

- Suddenly, both the volume traded and the price begin to pick up as the insiders scoop up as many of the shares as they can, buying from holders who have become disenchanted with the share's lack-lustre prospects.

- Their activities result in the share price rising slightly, but on a huge increase in volume.

- A public announcement is made and everyone is told what is happening.

- The share price rises sharply on the news and the insiders quietly off-load their shares to realise a huge capital gain.

It is important to note that they cannot hide their activities from you as a private investor because it is clearly visible in the price and volume traded.

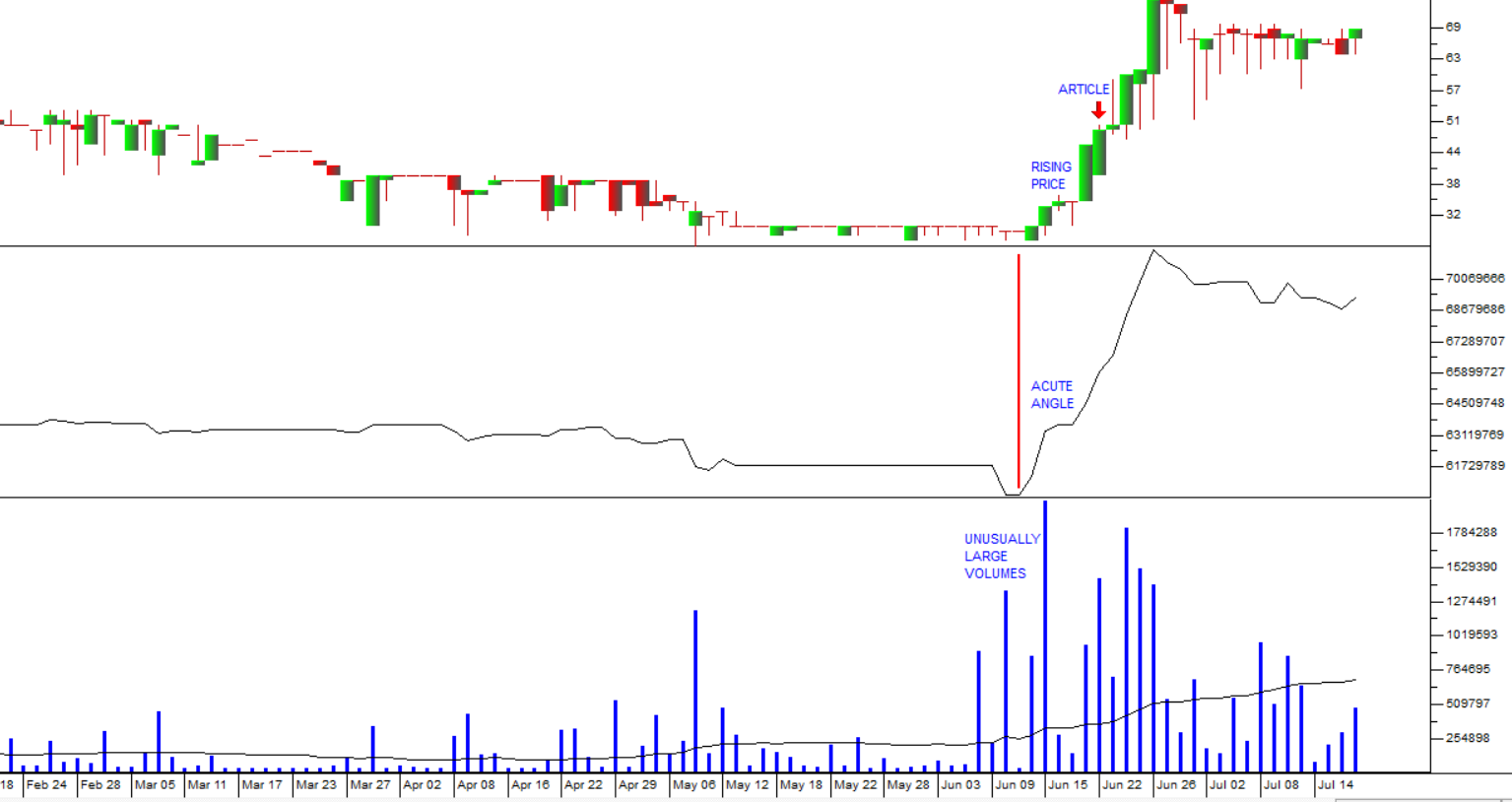

Consider the example of what happened to Quantum (QFH) last week. Until Friday 1st March 2024, QFH traded on average 3504 shares a day and was wallowing at a price of around 450c. On Monday suddenly, the price ticked up to 525c and there were 105165 shares traded – clearly, something was going on. On Friday, the share closed at 950c – a gain of 80,9% in just five days! Consider the chart:

For more than a year, Quantum traded with almost no daily volume and was stuck in a narrow price range below 500c a share. On Friday 1st March 2024, it closed at 450c with 12040 shares changing hands.

On Monday 4th March 2024 it closed at 525c and 105165 traded. That was a clear sign that someone was buying all the shares they could get their hands on at low prices. There were plenty eager sellers who had been sitting on their shares for months at prices between 450c and 500c – so the opportunity to sell their holdings for 525c looked like a bargain.

Then as the pool of shares began to dry up, the share price rose sharply on Thursday and Friday to over 900c a share on massive volumes. On Thursday 777489 shares traded and on Friday a massive 1,3m shares traded.

We added the share to the Winning Shares List on Monday at 525c, making it possible for you to exploit this relatively rare opportunity to make a substantial capital gain. We hope you took the opportunity…

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: