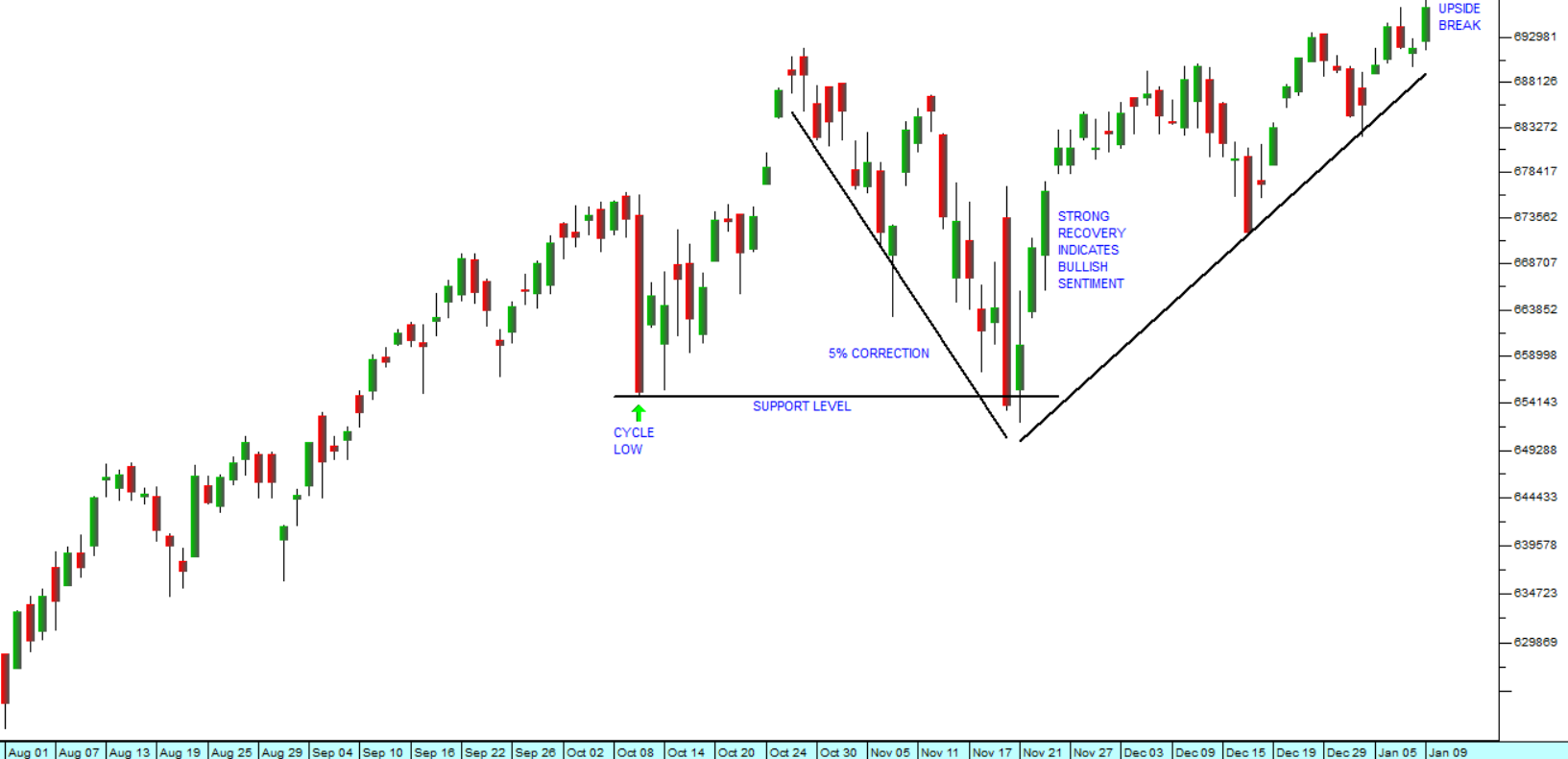

Technical analysis is the study of investor perceptions as they are reflected in the price and volume patterns of a security. It is also true that shares move in cycles which take them from being overbought to being oversold and back again. This is especially true of the blue chip shares which are heavily traded and patronised by the big institutions (pension funds, unit trusts and insurance companies). The fund managers who manage the institutional portfolios account for about 90% of all trades on the JSE.

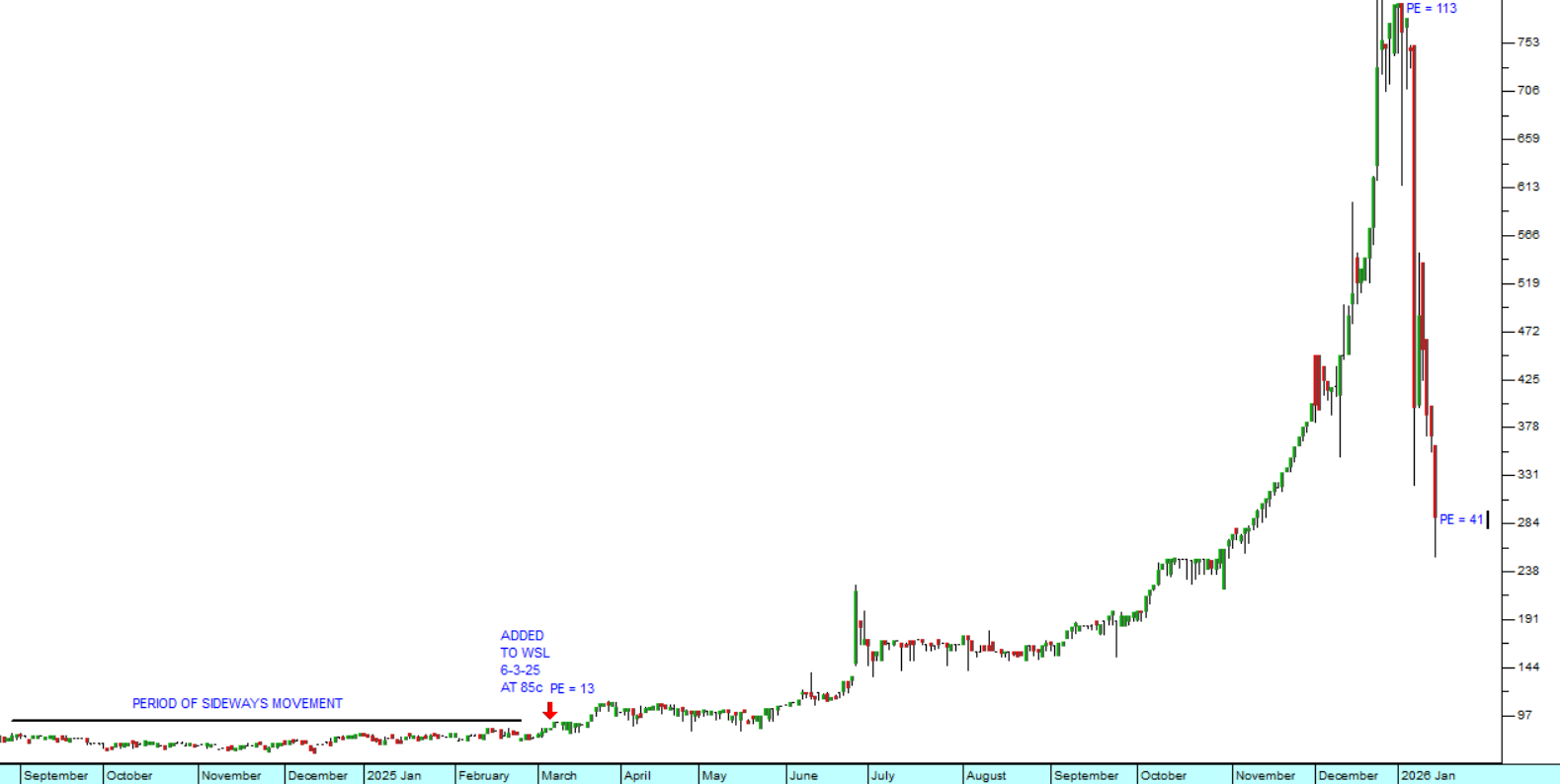

In our opinion, Clicks (CLS) is a high-quality share which should be part of every private investor’s portfolio. The problem is that it is generally very popular with the big institutions who are always buying it, which tends to make it very expensive – most of the time. But there are occasions when it goes out of fashion with the fund managers for some reason and at those moments it can represent excellent value and a great buying opportunity. In our opinion, right now is just such a moment.

A few days ago on 22nd January 2026, Clicks published a trading update for the 20 weeks up to 11th January 2026. In that update it said that group turnover was up 7,4% and that pharmacy sales had gained 9%. They also commented that they had record Black Friday sales and robust customer demand for their Christmas gift range.

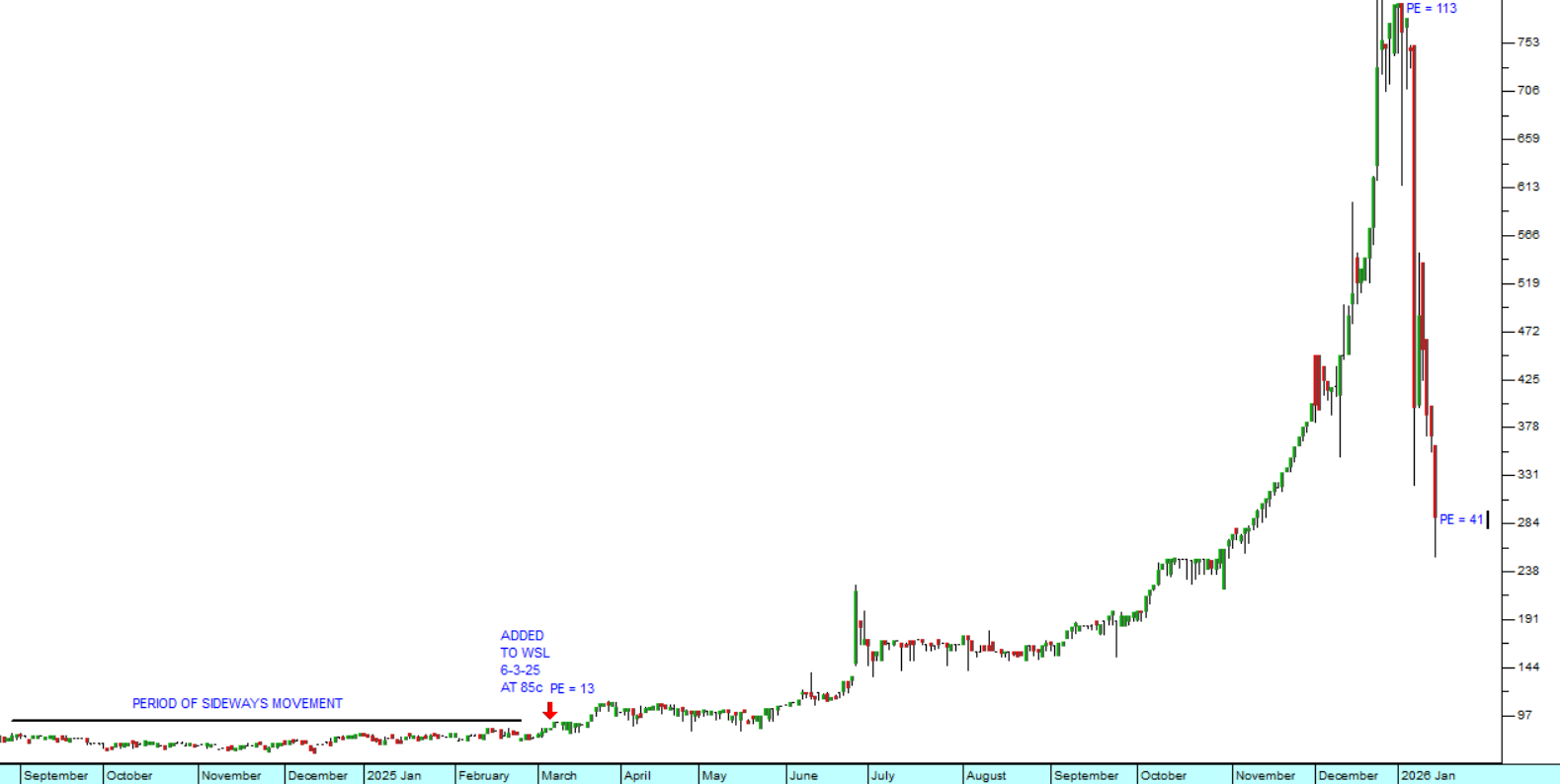

Consider the diagram below.

Clicks (CSL) : February 2016 - 23rd of January 2026. Chart by ShareFriend Pro.

Clicks (CSL) : February 2016 - 23rd of January 2026. Chart by ShareFriend Pro.

The top chart in the diagram below shows the share price of Clicks over the last ten years. The lower chart shows the 200-day overbought/oversold (OB/OS) of Clicks over the same period.

On the OB/OS I have drawn in a -10% buy line and you can see that over the ten-year period there have been just 5 occasions (the green arrows) on which the OB/OS has fallen below -10%. Then considering the top chart you can see that, on each of those occasions, Clicks represented an excellent buying opportunity (the red circles).

On Friday last week, the Clicks OB/OS ended the week at –10,64%. And you will observe that historically it generally does not spend a great deal of time below that minus 10% buy line. Inevitably, the fund managers become aware that it is heavily over-sold and begin buying it, driving the price up again.

Of course, the fact that Clicks is heavily oversold right now does not guarantee that it will not fall further and you should always maintain a stop-loss strategy. But, if you are buying, it does give you a good indication of your probability of being right. In my estimation, the share has spent about 2% of its time over the last ten years below that -10% buy line. That means that your statistical probability of being wrong in buying it at that level is therefore extremely low.

And you will have one great satisfaction – you are not buying it at +24% - but somebody did! Otherwise, the chart would not have gone there. It is amazing to consider that, less than 4 months ago on 25th September 2025, there were institutional fund managers buying Clicks at an OB/OS level of over +24% (the red arrow). If you buy now at -10,64%, you are certainly doing a lot better than them!