Capitecs PEG

19 February 2018 By PDSNETThe badly researched report on Capitec by Viceroy has left the share trading at a significant discount. Following its immensely successful criticism of Steinhof, Viceroy's report on Capitec was underwhelming to say the least.

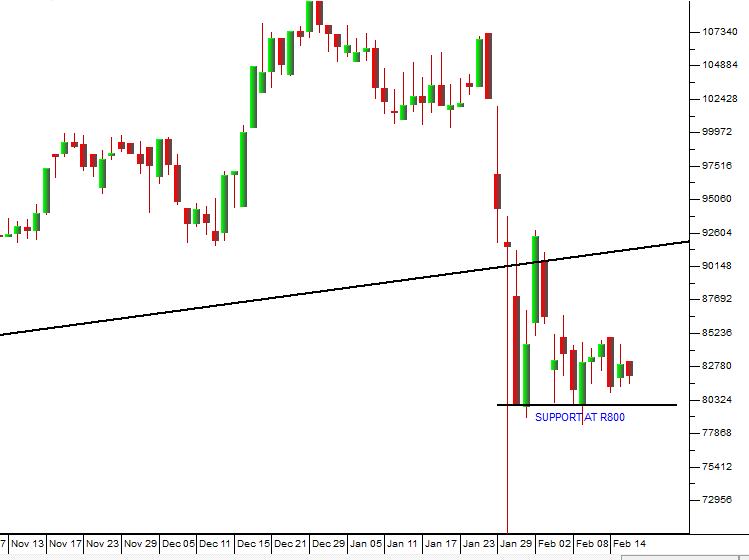

Capitec's CEO and many analysts have come out in strong support of the share - saying there is nothing wrong with its business model or its management of its delinquent loan book. It is also supported by both PSG and the Reserve bank. Nonetheless, the share price continues to wallow at a 25% discount to its peak of R1097 per share made on 29-12-17.

Why hasn't it recovered back to previous levels? Could there be something in the Viceroy report after all? Or is it just matching the general sell-off in world markets which is now in progress? Perhaps it was always trading at an excessive multiple and now some reality has crept into its share price. It is this last suggestion that we wish to examine in this article.

About a year ago, we published an article on the Price:Earnings Growth Ratio known as the "PEG" and suggested that it was a very good way to evaluate dividend paying blue chip shares. It is very instructive to re-visit this concept in the light of what has happened to Capitec.

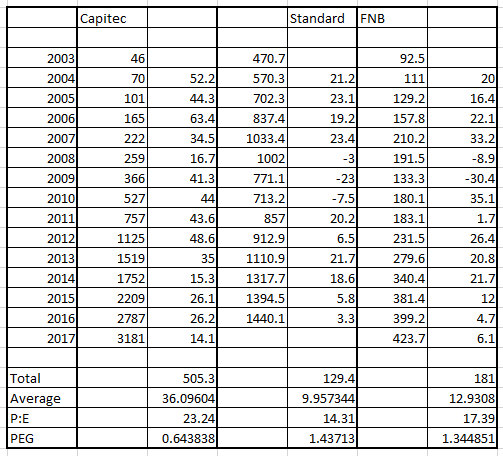

The PEG ratio is calculated simply by dividing the share's average headline earnings per share (HEPS) growth into its current P:E ratio. The resulting number gives a very good idea of whether the share is over-priced or under-priced - and it is interesting to compare it with other shares in the same sector. In general, a PEG below 1 shows value and vice versa. The lower the PEG the better value the share represents at its current price.

In our article last year on 2-3-17 we calculated the PEG for Capitec at 0,63 and Standard Bank at 0,93 - so both shares represented value, but, clearly, Capitec, despite its much higher P:E ratio, was much better value than Standard.

Since then both companies have added a new set of results and now Standard Bank's PEG is 1,44 and Capitec's is 0,64. For comparison, FNB is at a PEG of 1,34. The change in Standard Bank's PEG mostly reflects the rise in its share price and hence its P:E ratio. Back in March last year, Standard Bank was on a P:E of 10,3 whereas today it is on a P:E of 14,3. The sharp rise in its share price in the last three months is to blame.

So PEG analysis shows that Standard Bank and First National are over-priced at current levels while Capitec is cheap. So if you accept that the Viceroy report was incorrect, Capitec represents a buying opportunity. Here are the numbers:

This type of research is very easy to do for any listed share using the ShareFriend Pro software. All the earnings figures are given in the comment feature on each listed company and the current P:E ratio is available at the top of the chart.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: