The Year Ahead

10 January 2019 By PDSNET2019 is going to be an interesting year both locally and internationally.

In our view, the American economy is almost certain to continue growing rapidly � and that growth must, sooner or later, be reflected in share prices.

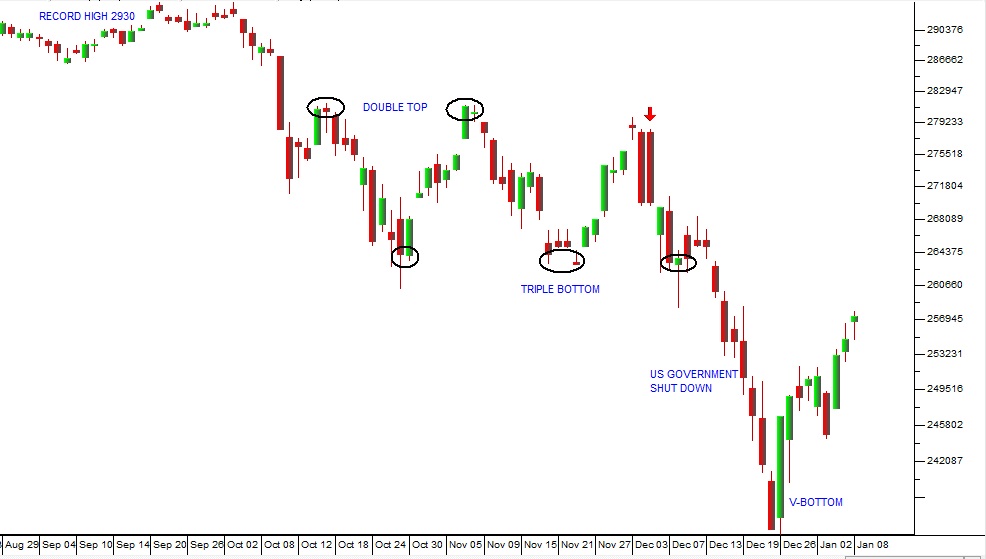

In our last article we suggested that the collapse in the S&P500 index over December was unprecedented and suggested that it was probably due to the temporary shut-down of the US government (clearly caused by Trump) at a time when most investors were away on holiday. We suggested that as soon as they returned, we would probably see a �V bottom".

That �V bottom" is now well on its way. Consider the chart:

S&P500 Index August 2018 to January 2019 - Chart by ShareFriend Pro

It is clear that the broad thrust of investment opinion is that the shut-down is a temporary set-back which does not materially interrupt the general recovery in the American economy. On the local front, the election will dominate the news this year. International investors have been very concerned about the outcome of this election because Ramaphosa is not yet an elected president. They were concerned that the ANC would fall below the 54% support that it got in the last election � or worse, fall below 50% and be forced to make a deal with one of the two opposition parties. Two recent polls, one by Ipsos and one by the Institute of Race Relations suggest otherwise. Both indicate that the ANC is likely to win around 60% of the vote in May. This changes the whole investment picture. If Ramaphosa is about to get resounding support from the electorate for his reforms, then he will surely have the mandate he needs to continue and even extend his reforms. We believe that if the ANC wins 60% of the vote in May it will open the door for the more fundamental structural reforms such as:- Changing the labour legislation to make it easier for employers to fire people. By making it easier and less expensive to fire employees, the government will open the door for business to hire more. At the moment businesses are so concerned about how difficult it is to get rid of someone that they are avoiding hiring people which contributes significantly to the very high levels of unemployment in this country.

- Privatising most state owned enterprises (SOE), which would generate capital to reduce the government debt and ensure that these businesses performed profitably. For many of the 200 SOEs in South Africa (like SAA) there is absolutely no reason for them to be government owned and run.

- Reducing the size of the civil service. The number of people employed in government and quasi-government organisations is hugely excessive by almost any measure. Probably, that number should be reduced by half.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: