The Rand and Ramaphosa

19 January 2018 By PDSNETIn our previous article on Steinhof and EOH, we discussed the fact that private investors seldom have enough information to make investment decisions when events move quickly in the share market – as they did with Steinhof and EOH. We suggested that the answer to this dilemma was to watch the charts because those people who do have inside information will inevitably trade to take advantage – and their activities will be visible to everyone in the price and volume patterns of the share. This makes technical analysis an essential item in the private investor’s tool-box.

The same principle can be applied to other markets – and especially the South African rand market. This market is a favourite of international currency speculators (George Soros and the like) because it is very liquid when compared to other emerging markets trading at least R50bn a day. This liquidity has made it the darling of international currency speculators. These people have enormous sums of money at their disposal, usually in US dollars – and they stand to win (or lose) an enormous amount if they position themselves correctly (or incorrectly). For this reason they do their homework well – and they have the money and the motivation to pay generously for inside information.

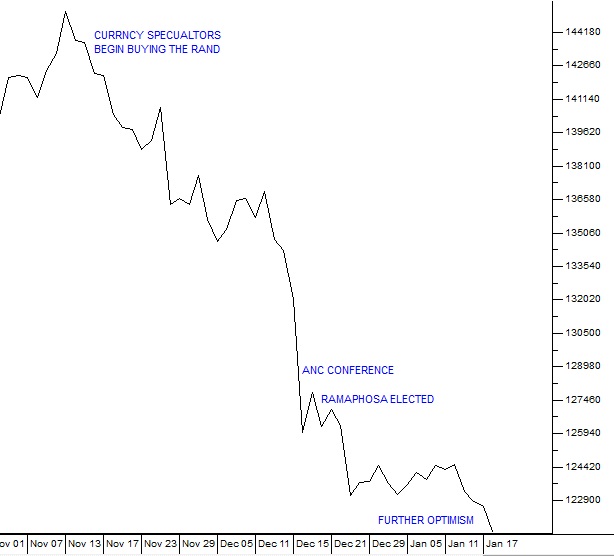

Perhaps the most telling example of their activity in the rand market occurred late last year around the ANC’s elective conference. Consider the chart:

Rand Dollar Exchange Rate - Chart by ShareFriend Pro

The rand began to strengthen on 13/11/2017 from its weakest point in the current cycle of R14.52 to the US dollar. Since then it has strengthened to current levels around R12.10. What is interesting about this sharp turnaround is that the ANC’s elective conference only began on 16th December, more than a month later, and the result was only known on Monday 18th December 2017. This supports our view that powerful currency speculators (probably international), playing the rand market, had good quality inside information on the likely outcome of the conference and acted on it well before it became public knowledge. This type of well-informed trading by major currency speculators makes the rand/dollar exchange rate an excellent barometer of major political events in South Africa. For the private investor, keeping a close eye on the rand was always a far better indicator than trying to make sense out of press articles on the voting patterns in the provinces and the so-called “unity votes” prior to the conference. So far the rand has appreciated by just over R2 to the US dollar. Further improvement will depend on what happens next and how Ramaphosa manages what must be an extremely delicate and finely balanced power struggle. He clearly needs to consolidate his position before he can make any radical changes. The pattern of the rand since the conference shows a period of sideways movement between R12.30 and R12.45 since his accession, but in recent days it has strengthened further to under R12.10. This is probably a good indication that Ramaphosa is inexorably winning ground against the Zuma/Gupta alliance.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: