The Confidential Report - July 2017

5 July 2017 By PDSNETWhen you buy a share, you are in the business of predicting the future. You are saying, “I am buying this share because I expect it to go up”. The accuracy or otherwise of your prediction will determine whether your investment is profitable or not. And the only way to predict the future is to study the past. There is no other way. The only reason that you know that the sun will rise tomorrow is because you have seen it happen before. If you did not have that experience, you would not be able to make that prediction with any confidence. It would simply be a guess. Forecasting is not an exact science. Predictions can never be certainties. Indeed, investment is not about certainties – it is about probabilities. A sound investment is one which has a better than 50% probability of going up. Any probability less than that is a gamble where the odds are stacked against you. Understanding the relationships and risks in the stock market is very important for the private investor. Without a solid grasp of the context within which the world economy and stock markets are moving, it is impossible to comprehend and interpret what is happening now, let alone predict what will happen next or assess the risks.

Bull and Bear Trends

It has been well said that nothing in the markets moves in a straight line. There will always be [glossary_exclude]bull[/glossary_exclude] and bear trends and those trends will always be broken by periodic corrections and rallies. And there is no service that you can obtain that will tell you whether you are in a [glossary_exclude]bull[/glossary_exclude] or [glossary_exclude]bear[/glossary_exclude] [glossary_exclude]trend[/glossary_exclude], or when exactly the one gives way to the other. These are decisions that you have to make for yourself. And they are very important decisions because during a bull trend roughly 80% of shares go up – and vice versa. In a [glossary_exclude]bull trend[/glossary_exclude] you can buy almost any share, even if it is not very good quality, and it will go up simply because the entire market is going up. In a [glossary_exclude]bear trend[/glossary_exclude], even very [glossary_exclude]high[/glossary_exclude] quality shares will probably fall in sympathy with the overall trend. Broadly speaking, as a private [glossary_exclude]investor[/glossary_exclude] you want to be out of the market entirely during a [glossary_exclude]bear trend[/glossary_exclude] and [glossary_exclude]close[/glossary_exclude] to fully invested in a [glossary_exclude]bull trend[/glossary_exclude]. And you need to grasp the fact that the existence of a [glossary_exclude]bull or bear trend[/glossary_exclude] on the JSE is not something which is determined here in South Africa. Rather, the over-riding direction of our markets follows that of the international markets – especially Wall Street.Markets lead Economies

An important aspect of your understanding is the awareness that markets always move in advance of economies. This is because investors are motivated to study the direction in which economies are moving and then take appropriate actions to protect and enhance their investments into the future. Thus, in March 2009, when the S&P500 index was at a low of 666, the smart money began buying up shares at basement bargain prices even though, at the time, the media and many economists were saying that we were headed into a depression similar to the one which gripped the world after the 1929 crash. But the smart money knew, even then, that the huge and on-going injection of cash by central banks into the world economy, combined with record low rates of interest world-wide, had to have a significant impact on growth sooner or later. And the brave among them began buying shares in anticipation of that growth. As the years passed and their conviction that we were heading into a boom phase increased, they bought more and more stocks at higher and higher prices. They are still doing that, eight years later. That explains why the S&P500 [glossary_exclude]index[/glossary_exclude] has been rising inexorably for 8 years and shows no signs of topping out yet. The smart money is still in there – and their foresight has been rewarded because the S&P is now trading at around 2430 – nearly four times its March 2009 low.The Exponential Bull

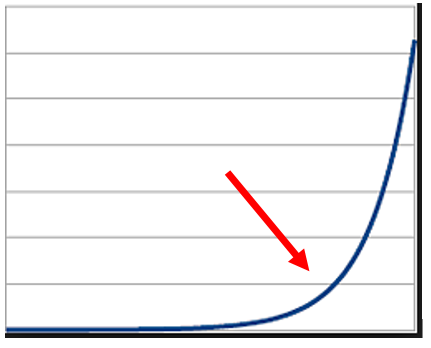

Great bull markets, like the one we believe we are in, are usually exponential. In other words, they rise relative slowly and tentatively to begin with and then gain [glossary_exclude]momentum[/glossary_exclude] until they are rising almost vertically. We believe that we are now somewhere on the curve between the gradual climb and the steep rise (roughly where the red arrow is). In the previous Confidential Report last month, we gave the history and background to this belief. If you missed that or cannot recall what we discussed, go back and re-read the notes.

We believe that we are now somewhere on the curve between the gradual climb and the steep rise (roughly where the red arrow is). In the previous Confidential Report last month, we gave the history and background to this belief. If you missed that or cannot recall what we discussed, go back and re-read the notes.

Systematic and Unsystematic Influences

When financial analysts talk about the “systematic” and “unsystematic” risk in the share market they are attempting to distinguish between that risk which is inherent in the market as a whole (i.e. the system), and that risk which is particular to a specific share. This separation makes good sense, even for private investors. When you buy a share, you become exposed to what is called “market sentiment” – which can be either bullish or bearish and you are also exposed to the risks in the particular company whose shares you have chosen to buy (i.e. the “unsystematic” risk).Market Similarities

One of the most important understandings is that the stock markets of the world generally move together – following what happens on Wall Street. In the first world, this “lock-step” is very obvious from their major index charts. Consider the following charts of the S&P500, the London FTSE, and the German DAX:

S&P500 Index March 1998 to July 2017 - Chart by ShareFriend Pro

FTSE Index February 1998 to July 2017 - Chart by ShareFriend Pro

DAX Index December 1997 to July 2017 - Chart by ShareFriend Pro

All these markets, to a greater or lesser extent, experienced:- The [glossary_exclude]bull[/glossary_exclude] market to September, 2000,

- The 9/11 bear market that ran until March 2003,

- The [glossary_exclude]bull[/glossary_exclude] that lasted until October 2007, pushed by Greenspan’s zero-percent interest rates in the US.

- The sub-prime crisis that took markets down to their nadir in March 2009,

- The subsequent 8-year bull trend interrupted by corrections in 2011 and 2015.

Comparative RSI FIN-30 / Rand Dollar - Chart by ShareFriend Pro

You can see that in US dollars, the financial and industrial shares of the JSE follow a similar pattern to the S&P500 over time. Obviously, the weakening of the rand over the 19 years covered in this chart (i.e. back to February 1998) had a major impact. Share prices generally adjust for the weakness in the rand – so rand weakness has caused the nominal value of our shares to rise much more than other world markets. But the chart makes the point that our markets follow Wall Street – after aiming off for the fluctuations in our currency.The Rand

Over the years, our currency has fluctuated widely, but mostly weakened against so-called “hard currencies” like the US dollar. Almost all shares trading on the JSE are rand-hedges to a greater or lesser extent, simply because they represent real businesses which will adjust and appreciate when our currency is debased. Obviously, some shares have a far greater rand-hedge component than others, because they have a varying percentage of their incomes and profits which are derived in a first-world currency. A few shares, notably importers, actually benefit from a strengthening rand. As a private investor, you should always keep a [glossary_exclude]close[/glossary_exclude] eye on the strength or otherwise of the rand. You should have a view on what you think its future prospects are and make your investment decisions accordingly. During 2016 and for the first few months of 2017, the rand strengthened under the leadership of Pravin Gordhan as Minister of Finance. What is surprising is that the rand appears to be continuing to strengthen and certainly hasn’t weakened since Gordhan was fired and South Africa went through a series of downgrades by the international ratings agencies. How can this be? The experts say it is because of the international “search for yield” where first-world investors are looking for better returns than they can get in first world countries where interest rates are still [glossary_exclude]close[/glossary_exclude] to zero. The argument is that this has combined with an improvement in commodity prices to make emerging markets like South Africa a more attractive investment destination.

Rand Dollar May 2015 to July 2017 - Chart by ShareFriend Pro

In our view, the rand was very heavily over-sold when Pravin Gordhan took over as Finance Minister and it has been on a recovery path since the beginning of 2016. We also believe that it is discounting the growing weakness in the ANC and the probability of some sort of leadership change in the next year or two leading up to the 2019 elections. Emerging markets will benefit most from the economic recovery in the US and Europe by supplying them with various commodities – so perhaps it is natural that the rand should continue to strengthen, despite the ratings downgrades. But as you can see from the chart above, the rand appears now to be weakening to test the trendline. A significant and sustained break through this trendline would signal a resurgence of negativity about South Africa’s future prospects. In our view, this is unlikely. Our view is that if the rand was going to enter a new weakening phase it probably would have done it by now – after all we have had enough bad news! No, it appears more likely that the rand is beating to a different drum. It is signalling a “sea-change” in the status quo. The trend that was initiated by Gordhan’s appointment was not materially disturbed by his firing. We suspect that the SA economy may be beginning to benefit from the general recovery in the world economy.Wall Street

In the previous Confidential Report we discussed at some length the history of the US economy and Wall Street, going back to the 1929 crash and the Great Depression of the 1930’s. We talked about the emergence of John Maynard Keynes in the mid-1930’s and the impact of his “General Theory” on the approach of Alan Greenspan to the 1987 crash. We discussed the effect of Greenspan’s and subsequent Federal Reserve Bank Governors’ policies, leading up to the massive quantitative easing and record low interest rates which followed the sub-prime crisis of 2008. We suggested that, due to extraordinary monetary policy stimulation over the past 8 years, Wall Street was in the throes of a massive bull trend which began in March 2009 and which is far from over. To refresh your understanding of this discussion, re-read the relevant portions of last month’s Confidential Report Notes on our website. The bull trend is currently eight years old and that is making some analysts, especially in America, very nervous. They point out that such a long bull trend is almost unprecedented in recent history and that a [glossary_exclude]bear[/glossary_exclude] trend is “overdue” simply on the basis that the bull trend has been going on for such a long time. This is similar to the suggestion that a major earthquake is overdue in California simply because there hasn’t been a big one for a long time - but how long is a “long time”? In our view, however, historical norms for how long a bull trend typically lasts are largely irrelevant now - because the particular set of circumstances and actions which gave rise to this bull trend are themselves unprecedented. We have never been in this situation before – never before has in excess of $12,5 trillion been created by central banks and injected into the world economy. Nobody can (or has even tried to) predict the possible consequences of such a huge and prolonged monetary intervention. Other analysts have pointed to the price:earnings ratio (P:E) of the S&P500 and suggested that it is at a historically high level and is thus due for some sort of correction. This is a more serious assertion and deserves some consideration. The current average earnings on the S&P500 companies stands at $94.50 per share. This is expected to increase to $118.40 in 2017 and then to $133.80 in 2018. These figures indicate that the S&P is currently on a historical P:E of 25.7 and a forward P:E of 18.2 using the 2018 projection. But is that over-priced? The long-term average P:E for the S&P is 24.25 – since records have been kept. During the 1998 dot-com bull trend, the S&P traded as high as P:E of 33.5. If it reaches that level by 2018, then the S&P will be at 4482 (133.8 X 33.5) – which is a gain of 84,3% from current levels - over the next two years. And that assumes that the 1998 P:E ratios are the highest that the P:E will go. Based on our analysis that we may well be headed into the greatest bull market in history – an [glossary_exclude]asset[/glossary_exclude] bubble, the likes of which have never been seen before, the historical norms just don’t apply. We expect that in this great bull trend, eventually, there will be a total disconnect between share prices and the earnings of the companies that they represent. In other words, at the peak of this bull market, the relationship which the P:E [glossary_exclude]ratio[/glossary_exclude] is supposed to represent will break down completely. Already, we have some exceptional shares listed on the JSE, like Naspers and Curro, which are trading on P:E’s above 100. What is clear from this discussion, however, is that the current fears of some analysts that the S&P is over-priced on an earnings basis – and so due for a major correction or [glossary_exclude]bear[/glossary_exclude] trend – cannot really be sustained. What is interesting about the companies which make up the S&P500 is that their average profit growth in the second quarter this year was 6,5%. This looks pretty good until you realise that half of that growth came from the energy [glossary_exclude]sector[/glossary_exclude] where profits were up over 400% from last year’s very dismal results. Obviously, this reflects the terrible state of the energy market last year and the sharp recovery this year. Without energy, average profits among S&P companies grew at a more sedate 3,6%. This might indicate that there is still considerable room for upside in the index.Political

Almost every day, the headlines are dominated by further leaked e-mails providing evidence of the capture of state entities or their financial exploitation by the Guptas. The sheer weight of evidence makes it unlikely that the leaked e-mails are some kind of elaborate hoax and the revelations go well beyond the previous Public Protector’s state capture report. It now seems apparent that state funds have been systematically plundered over an extended period of time. Whether any of this will result in a prosecution remains in abeyance. Are the e-mails sufficiently hard evidence to obtain a conviction? What is increasingly clear, however, is that for the ANC/Guptas to remain in power after 2019, they will almost certainly have to subvert the electoral system. Our new Minister of Finance, Gigaba has warned “significant risk remains to the achievement of our fiscal targets”. In layman’s language this means that the government is running out of money. Normally, when this happens the government has two possible courses of action – reduce spending or increase taxes. Reducing spending tends to be very unpopular and difficult to do, so increasing taxes is what the previous Minister of Finance, Gordhan elected to do. The only real option now for further tax increases would to raise VAT. Right now, South Africa’s VAT [glossary_exclude]rate[/glossary_exclude], at 14%, is one of the lowest in Africa. The problem is that increasing VAT will be very unpopular and the ANC is reluctant to lose even more ground with the masses in the run-up to the 2019 elections. There is, of course, another alternative which is to simply print the money and allow inflation to rise. This is the method that was employed by Robert Mugabe in Zimbabwe which eventually emasculated the Zimbabwean economy. But you should consider that either a sharp increase in VAT or much higher inflation is more or less inevitable. The Public Protectors recent remarks regarding the Reserve Bank are both dangerous and populist. She (Busisiwe Mkhwebane) is suggesting that the [glossary_exclude]Reserve[/glossary_exclude] Bank [glossary_exclude]abandon[/glossary_exclude] its role of maintaining the stability of the rand and focus on “citizens’ socio-economic well-being”. In effect, this means inflating or debasing the currency and using the proceeds to address the needs of the poor. On the face of it this might sound laudable, but the longer term inflationary effect of increasing the money supply will be to make the poor suffer even more. They are served best by a stable currency. Mkhwebane is echoing the ideas expressed by Professor Malikane (advisor the Minister of Finance, Malusi Gigaba) who wants to see the nationalisation of the banking [glossary_exclude]sector[/glossary_exclude]. Such populist rhetoric may win some [glossary_exclude]support[/glossary_exclude] with the masses, but it scares off international investment from South Africa – and that is good for no one.Economy

Predictably, the South African economy has fallen into a technical recession – two successive quarters of negative growth. In our view, this “recession” will be as short-lived as the previous one (2009) and will probably not see out the year (2017). The reason for this is the rapid recovery of the world economy (especially the US). Already, our manufacturers are seeing an uptick in export orders and we expect this to be the trend going forward. The US economy is moving into overdrive, creating hundreds of thousands of new jobs every month. Europe is seeing growth pick up in sympathy with previously depressed economies like Spain now growing at 3,2% per annum. There is also the possibility that the South African Monetary Policy Committee (MPC) will see this as a reason to cut interest rates by either 0,25% or 0,5%. Clearly, the consumer is under great strain financially, inflation is falling and a [glossary_exclude]return[/glossary_exclude] to growth is vital. The application by Eskom to have a 20% increase in electricity prices on the grounds that there is lower usage shows that this giant monopoly is slowly dying. The lower usage comes from the economic recession, but it is also rooted in the general move away from Eskom by both households and businesses. Advances in renewable energy technology, especially battery technology and photo-voltaic panels, are making Eskom increasingly unnecessary. As its prices go up, it will force more and more people to make plans to “get off the grid” – and that will presumably motivate further price hikes in a vicious circle. The advent of electric motor vehicles over the next ten to fifteen years will see the demand for electricity rise, but it seems unlikely that Eskom will be a major beneficiary of this trend. In the short term, a further 20% rise in electricity prices will have a major negative impact on the economy and employment levels – but in the longer term it may force us to adopt renewable energy more quickly. The ratings downgrades, where two of the three international ratings agencies have South Africa on junk status and the third has us just one notch above junk with a negative outlook, have attracted much press. But the fact of the matter is that these ratings downgrades were already long discounted into the share and bond markets. The real impact of these downgrades is that it has become much harder for South Africa to attract the overseas investment capital it needs to grow in the future. A “catch 22” situation is developing where we cannot get capital because of our junk rating and where the junk rating is there because of our inability to grow our economy. The latest inflation figures show the Consumer Price Index (CPI) at 5,4% for May month – slightly higher than the 5,3% recorded in April. This is within the [glossary_exclude]Reserve[/glossary_exclude] Bank’s target [glossary_exclude]range[/glossary_exclude] of between 3% and 6% and reflects the sharp drop in food prices following the much-improved maize crop this year. The stability of the rand, which our new Public Protector wants removed as a primary objective of the [glossary_exclude]Reserve[/glossary_exclude] Bank, is critical to the economic survival of South Africa. If targeting was abandoned, inflation would quickly rise to double digits, something which the poorest of the poor simply could not afford. The fact of the matter is that low inflation improves the financial position of all consumers, but most of all the poor.General

South Africa will collect about R1,26 trillion in the tax year which ends on 28th February 2018. Of this, about 38% or R480bn is personal [glossary_exclude]income[/glossary_exclude] tax. About 90% of that personal income tax comes from just 40% of the tax-paying population who earn R25 000 per month or more. In effect, about 3% of the population is paying 80% of the tax. This statistic shows that the economy is badly skewed – which is to be expected in an emerging economy. We have a small number of highly educated, productive individuals supporting a massive number of uneducated or semi-educated individuals. The logical way to address this is through education. Simply taking money from the “haves” and giving to the “have-nots” will not achieve the objective. It will kill the goose which lays the golden eggs. It is a resounding truth that the mind cannot be re-distributed through a process of affirmative action. The recent decision by the Constitutional Court which prevents squatters from being evicted if such eviction renders them homeless will have significant implications for South Africa. It legalises occupation by millions of squatters across the country and gives them some security. It is however a problem for landlords whose property has been so occupied because it basically makes their property valueless. The Mayor of Johannesburg has vowed to clear the squatters out of at least fifty buildings in the Johannesburg area, to refurbish them and to rent them out for income. Now he will have to ensure that the squatters that he displaces have alternative accommodation. A listed company’s empowerment credentials can be vital to its success and most companies strive to improve their BEE scorecard in whatever ways they can. This is especially true for large financial organisations and banks. Wiphold has made a business out of helping banks to improve their BEE scorecards. Back in 2005, Nedbank engaged with Wiphold and saw its BEE rating climb sharply to level 2. This obviously makes it the preferred bank for the many government departments and parastatals that need banking facilities. Now Wiphold has engaged with Sasfin, agreeing to become its shareholder of reference with just over 25% of its share capital. This assistance comes at the cost of R517 000 a month billed as a “management fee”. Given Sasfin’s rather dismal share price performance this year, Wiphold could help it to regain some investor interest. The cost of maintaining a listing on the JSE is substantial – around R3m per annum. This means that if your share is not trading significant volumes and you have no intention to raise capital by issuing more shares, the listing may not be worthwhile. This is the case for Moneyweb – a well known name in South Africa for investment and financial analysis. It has decided to delist after being listed for 18 years. The company’s market capitalisation is around R30m – so the listing is costing it about 10% of its market cap. per annum. Clearly that does not make business sense.Commodities

It is no secret that the government has systematically attacked the mining [glossary_exclude]industry[/glossary_exclude] in South Africa almost since the ANC came into power, and especially over the past fifteen years. This, combined with the low price of commodities and aggressive union action, has reduced the industry to a fraction of the size that it was at the beginning of this century. One of the most dramatic examples of this is what has happened to private operators in diamond mining. Since 2004, the number of such operators has declined from 2000 to 150 and employment in the industry has fallen from 25000 to just 3000. And this is during a period when the ruling party made the reduction of unemployment one of their key objectives. Policy uncertainty, mine safety stoppages and red tape have effectively destroyed what used to be a solid contributor to the SA economy. The Chamber of Mines has reacted with horror to the newly published mining charter saying it is unconstitutional and will completely kill mining investment in South Africa. The new charter (the third for the mining industry) seeks to increase the compulsory black ownership to 30% from 26% - and does so even for existing holders of mining rights. The Chamber and various other organisations are seeking an urgent interdict from the courts to prevent the new charter from taking effect. After that it is likely to be the subject of extended litigation. And, of course, all of this means that no more overseas capital will be invested in mining in South Africa – at least not until this is sorted out. It is apparent that Zwane (Minister of mineral resources) is intent on completely destroying the mining industry in South Africa – which will lead to widespread lay-offs and increased poverty. The new charter has already had the impact of pushing up Sibanye’s cost of borrowing for the Stillwater mine in the US. Gold and subsequently platinum mining were the industries that have established and paid for the industrialisation of South Africa. The mining of both metals has been in decline for some time now, weighed down by lower metals prices, rising cost of extraction, [glossary_exclude]union[/glossary_exclude] action and legislative uncertainty. It is now clear that the conventional mining of both metals, involving large semi-skilled labour forces, cannot persist much beyond 2023. For these operations to remain profitable, they will have to mechanise. This will enable them to move to 24-hour mining, making possible significant economies that will extend the life of the mines to 2035 and beyond. The time of the mining unions is coming to an end as mining houses increasingly close unprofitable shafts and retrench thousands of workers. Mechanisation, however, does hold the potential to revitalise South Africa’s precious metals industry over the longer term. We still have the world’s largest known underground deposits of both platinum and gold. The collapse of capital investment in mining world-wide has been remarkable. Capital expenditure among the world’s [glossary_exclude]top[/glossary_exclude] 20 mining conglomerates has fallen from about $140bn in 2012 to $38bn in 2016. This is because of the precipitous fall in commodity prices. Perversely, capital expenditure peaked when commodity prices were at their highest and is at its lowest in 15 years when commodity prices are at the lowest levels they have been for a long time. Clearly, the big mining houses are not followers of Warren Buffett’s philosophy of being greedy when everyone else is fearful and vice versa. The one exception may be Sibanye which has been on a buying spree, snapping up Anglo’s unwanted platinum assets and now buying the Stillwater palladium mine in the US for $2,2bn. Maybe Niel Froneman (CEO of Sibanye) has got it right – maybe he has bought tremendous mining assets right at their lowest point. Certainly, it is a feather in his cap that Sibanye was given a preliminary B rating for its recent bond issue. That will make the cost of the Stillwater acquisition much more affordable. The platinum price in rands has fallen off quite sharply over the past year. This has put most platinum miners under extreme pressure. It has been estimated that about 60% of platinum mines are operating at a loss. Annual platinum production in South Africa has already fallen from 5,3 million ounces to just 4 million ounces and will probably fall further as unprofitable shafts are closed. The balance sheets of most platinum miners are stressed and they cannot easily raise additional capital – which means that mine closures and consolidation are becoming inevitable. South Africa accounts for roughly 80% of the world’s platinum production so this restriction of supply will, in time, result in a shortage of platinum on world markets and a rising price. But right now it is an industry in stress where good quality assets can be picked up relatively cheaply. Neil Froneman, CEO of Sibanye, is taking full advantage and buying up quality platinum producers world-wide. If he is wrong then Sibanye will have loaded itself down with debt for nothing, but if he is right then Sibanye will profit hugely from the quality assets it has managed to acquire. In this regard, it is interesting to note that Sibanye’s recent rights issue to raise $1 billion was five times oversubscribed – indicating that investors are buying in to Mr. Froneman’s optimism. Illegal mining has become a major problem in South Africa. Run by mafia-style gangs this dangerous form of mining costs lives on a continuous basis. The miners often spend weeks continuously below ground and work in unsafe conditions with inadequate equipment. Sibanye, at its Cooke operations arranged for the capture and arrest of 303 illegal miners when its miners went on an unprotected strike stranding the illegal miners underground without the food and supplies which had previously been smuggled in by Sibanye’s own staff. 58 Sibanye employees have been charged for working with the illegal miners. The temporary closure of the mine is costing around R8m a day. One of the most important questions any company can ask itself is “What business are we in?” The answer to this question will tell them not only what business they are in, but also what businesses they are not in. For example, Gold Fields has recently entered into the business of derivatives trading. They have taken some forward contracts in fuel to hedge the price that they will pay. The proper function of hedging is to lock in prices so that you can ensure that you can continue to make a profit no matter what happens in the future. Thus, Gold Fields has bought forward its fuel needs in Ghana and Australia until the end of 2019 at today’s prices. This means that they effectively fixed the price they will pay for this fuel, no matter what happens in the market. Now, if the fuel price goes up, they will be protected, but if it goes down they will lose money. They are taking a bet that the cost of fuel will escalate and their forward contract will save them money. Sometimes, these forward contracts can result in a significant paper loss and the company has to ask itself if it is in the business of predicting the fuel price. In our view, Gold Fields is in the business of producing gold - not trading in commodity futures.Companies

RETAIL

Traditionally retail, for the big chains in South Africa, has been a matter of following the opening of new shopping malls to be certain of having a steady flow of new stores to exploit new shoppers. However, in recent times there has been a shift in the way in which consumers shop with more and more choosing to shop on-line and it appears that, with the recession, there may just be too many shopping malls competing with each other. The environment has changed – which makes one wonder about the wisdom of launching even more, even bigger shopping malls – like the current upgrade to Fourways mall. Companies like Edcon are talking about reducing the number of stores which they have and other retailers are looking at the logic of having too many stores too close to each other. Hyprop Investments which owns the Hyde Park and other A-grade shopping malls has been hit by the collapse of Stuttafords which was renting significant space in three of its malls. It will also be impacted by Edcon store closures and overseas chains like Zara which is scaling back in South Africa. The drop-off in consumer spending is impacting retail chains and through them Real Estate Investment Trusts and property companies that specialised in shopping malls. The new CEO of Shoprite/Checkers, Pieter Engelbrecht, who replaced Whitey Basson, has decided to tackle the Woolworths market of upper end shoppers. Traditionally Checkers and Shoprite have targeted the low end of the market, but with the recession and consumers taking strain, the upper end now appears more attractive. Checkers will introduce up to 500 new products to try and lure upper-end shoppers away from Woolworths. Competition in retail is clearly getting fierce.

JSE GERE Index July 2016 to July 2017 - Chart by ShareFriend Pro

You can see from the above chart of the JSE general retailers index that the sector was recovering quite well at the start of the year, but was badly affected by the firing of Pravin Gordhan and the subsequent ratings downgrades. Clearly consumers are holding back in the relatively uncertain environment.BANKING

Various digital technologies are impacting on the banking sector, with the big banks teaming up with so-called “fintech” companies. A good example of this is the cell-phone direct payment of bills using services like Snapscan or Zapper. Fintech companies are expected to take about a quarter of banking revenue in due course. Much of this direction has to do with identifying customer spending [glossary_exclude]patterns[/glossary_exclude] and current activities. For example, customers who are in the market for a new vehicle or a house could be identified and the necessary banking facilities checked and approved ahead of time. In time, the need for a branch network may [glossary_exclude]fade[/glossary_exclude] as more and more transactions are done on cell phones or other devices. There is even talk that banking as we know it could disappear altogether or be controlled by social media platforms like Facebook or Google.VUKILE (VKE)

In this report, we do not usually advise investors to consider Real Estate Investment Trusts (REIT’s) because their performance is relatively pedestrian. However, Vukile has attracted our attention as a possible exception. Over the past year Vukile has risen 19% while the property index has gone up just 1,5%. As usual, this exceptional performance is a function of a particular business leader, Lawrence Rapp, the CEO. He has concentrated on retail properties in Spain with the acquisition of 86% of Castellana in May this year. Rapp sees 200 million euros worth of retail assets that could be developed in Castellana. So this share represents a rand-hedge, growing investment located in Spain – which is leading the European economy out of recession with a 3,2% per annum GDP growth [glossary_exclude]rate[/glossary_exclude].

Vukile Property Fund January 2016 to July 2017 - Chart by ShareFriend Pro

You can see here that the trend in Vukile’s share price is positive, although relatively slow – which is what you would expect from a successful REIT.BRAIT (BAT)

Brait is a share which appears to be in free fall. The share has fallen from R165 in June last year to its current level under R60. The company is a holding company under the control of billionaire, Christo Wiese, who is well known for his astute business dealings. The main reason for the fall is the write-off of value in their latest acquisition, New Look, a clothing retailer in the UK. New Look’s value has been reduced from R35bn to just R7bn on the books. Yet management is still very confident that in time New Look will prove its worth according to CEO Anders Kristiansen. If you believe in Wiese and his management team, you should be watching this share closely, waiting for the turning point. Notably, in recent weeks at these low prices, the volume traded has picked up sharply. Of course, Brait sold its controlling stake in PEP stores to Steinhof – and that was seen by many as the jewel in the Brait crown. It is also worth remembering that Wiese owns 16% of Shoprite/Checkers.

Brait SA September 2015 to July 2017 - Chart by ShareFriend Pro

This chart shows the extensive sideways market that Brait went through, complete with a triple [glossary_exclude]top[/glossary_exclude] from late 2015 through to June of 2016. At that point it rallied again as indefatigable believers in Wiese bought the share up for the fourth time – but this time it could not reach the upper resistance line and fell away as disappointed investors abandoned it. This [glossary_exclude]failure[/glossary_exclude] to reach and pass the [glossary_exclude]resistance[/glossary_exclude] line after a triple top was a key technical signal that it would break down out of that sideways pattern and fall heavily. Now the share has fallen from R170 to R62 and appears to be making a bottom. Weise is still the man in charge and the CEO of Brait is optimistic. It looks risky, but then you are probably not going to make any money in the share market unless you can feel the risk when you buy. And, certainly, you would be doing much better that the institutions that filled their pockets with Brait at R170.KAAP AGRI

This company is a PSG-controlled company in retail and agriculture. It listed on the main board of the JSE on 26th June 2017 – so it has been trading for just 7 days. So far it has seen some stagging but is holding on to a price of about R60. We believe that it will represent an excellent investment for private investors once the initial stagging has taken place in the market. The company was previously trading on the OTC and last traded there at a share price of R55. Kaap Agri did not raise any capital on the listing. Its most recent results for the six months to end-March this years showed the company had a turnover of R3,46bn with headline earnings of R147m which was 208c per share. The company is already well-established and paying dividends. This year promises to be a much better year for agriculture than last so farmers will have more to spend at Kaap Agri’s 100 retail sites and 190 business units. Watch the share as its listing beds down and then choose your moment to get in. This could well be Dis-chem all over again.ANSYS (ANS)

This is a technology company that has been benefiting from the [glossary_exclude]roll[/glossary_exclude]-out of fibre and other technical solutions. It has the advantage of being black-owned and produced an excellent set of results for the most recent year. Turnover was up 70% while net profit was up almost 240%. From a technical perspective, the share is completing a “saucer bottom” and looks set to move up sharply, even though management says that the next year will probably be tough. In our view, this Alt-X listed company represents a good investment opportunity. It appears well-managed and growing rapidly through acquisitions.

Ansys January 2017 to July 2017 - Chart by ShareFriend Pro

CARTRACK (CTK)

This is an international company that focuses on tracking vehicles, especially trucks and fleets. They have launched their operation in America and they say that they have very good prospects there. America has relatively low penetration of this type of vehicle monitoring, but a new law which comes into effect in December this year will require that [glossary_exclude]commercial[/glossary_exclude] vehicles have electronic monitoring of service hours. That should result in about 3 million vehicles installing tracking devices in the next 2 years. The only real problem with this share is that it is extremely thinly traded – which makes it a much more risky investment because it is difficult to have an effective stop-loss strategy.CURRO (COH)

Curro Holdings is a remarkable company. It has grown turnover by 48% compound over the past three years, and profits by a compound 83%. Not many companies on the JSE can claim that. And that explains its PE: [glossary_exclude]ratio[/glossary_exclude] which is above 100 – which is much more modest than the P:E of 245 which it reached in December 2015. The company says that there is still considerable room for growth. Their target is to have 500 schools by 2030 – from the 127 schools which they currently have. Their current schools are also only 52% full which shows that there is room for many more students. As a PSG controlled company, Curro has access to funding and excellent management. Don’t forget to look at their latest spin-off – Stadio which is to be headed by Curro’s old CEO, Chris van der Merwe, and is listing on the JSE later this year. Stadio has a target of 13000 students in 2017, 35000 in the medium term and 65000 in the longer term. It seems that everything that PSG controls does well on the JSE.NASPERS (NPN)

It is interesting to note that in April 2002, you could have bought Naspers for 1260c per share. Today it is trading for 255000c and is one of the highest value companies on the JSE. If you look at a semi-log chart of Naspers over that period, you will see that the growth has been both steady and spectacular. And all of this because Koos Bekker had the inspired idea of buying a Chinese company called Tencent. Tencent has grown to be the foremost social media and messaging service in China at a time when the Chinese economy has itself been growing prodigiously. Of course, it has also benefited from the fall of the rand over that period. Now Tencent dwarfs the other Naspers assets (such as DSTV) to the extent that they are almost irrelevant and are seen as a drag on its overall performance. Because Naspers has been unsuccessfully trying to emulate its performance with Tencent by buying and nurturing other electronic platforms elsewhere in the world. From a private investor’s perspective, the problem with Naspers is that it is trading on a PE of over 100 and that means that it must keep performing in the way that it has been or the share will off-[glossary_exclude]load[/glossary_exclude] rapidly. Tencent grew turnover by 39% and its contribution to Naspers increased by the same in its latest results. Can it maintain this growth? Maybe, but it represents a high risk.INVICTA (IVT)

Invicta supplies engineering consumables and capital equipment to various sectors in the South African economy. Most of the companies that it supplies have felt the impact of the recession and reduced demand. Despite this, Invicta has managed to grow turnover by 8,4% in the year to March 2017 while headline [glossary_exclude]earnings per share[/glossary_exclude] (HEPS) went up 37,3%. This is an indication of tight cost control and good management. Companies which show that they are recession-proof are always worth considering. Invicta has seen its share price fall from around R74 at the end of last year to R56. There is strong support at R52 and we consider this share to be a good buy, especially if you believe that the SA economy will recover in due course.

Invicta Holdings December 2016 to July 2017 - Chart by ShareFriend Pro

The Confidential Report Webinars are hosted on the first Wednesday evening of the month and include a single comprehensive report covering the month and providing an overview of factors impacting the JSE including political developments, international markets, the local economy, commodities, currencies, individual JSE-listed stocks, and much more. The next Confidential Report webinar will be on the 2nd of August at 18:30. To register, click here.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: