Sasol: Resistance Becomes Support

23 July 2018 By PDSNETTwo years ago we wrote an article in which we drew your attention to the fact that Sasol, following its precipitous fall in 2014, had entered a sideways market bounded by support at R360 and resistance at R492. In September 2016, we suggested in another article that:

“It now looks, technically, as though the Sasol share price should move back up towards resistance at around R490”

And that is what happened – but only this year. Not only did the share reach that level (R492) but it broke above it giving a clear technical buy signal.

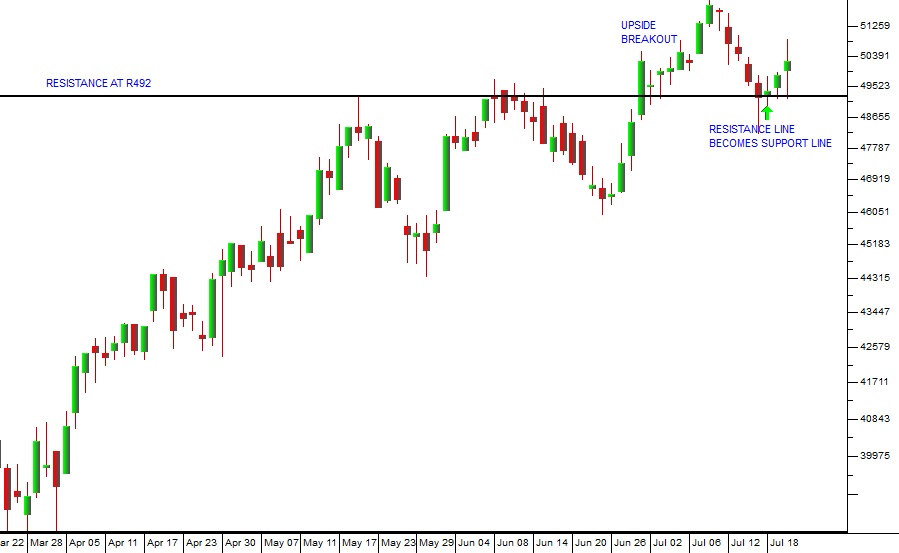

So what happens next? Well, in technical analysis, once a well-established resistance line like this is broken, it then usually becomes a support line. Typically the share’s price, having broken convincingly above the resistance, comes back to find that exact same level and bounces off it. Consider the chart:

Sasol (SOL) March 2018 to July 2018 - Chart by ShareFriend Pro

Here you can see how the share broke above R492 reaching as high as R521 before falling back to R492 and bouncing off that level. Of course, the Sasol story is about the recovery of the oil price since the beginning of 2016. It is also important, however, that Sasol has moved away from oil and should begin commissioning its ethane cracker plant in the US later this year. The shift towards more chemicals is likely to see the share re-rated further. A point-and-figure horizontal count suggests that Sasol could go as high as R1257. Consider the chart:

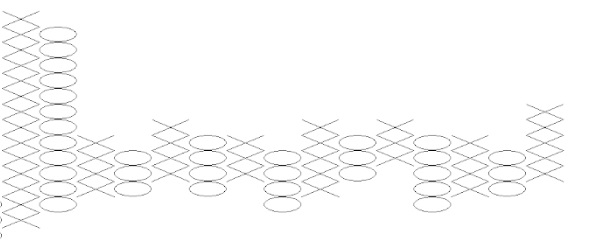

Point and Figure Chart of Sasol - Chart by Metastock

This chart shows the steep fall of Sasol shares from the high point in Mid-2014. That was followed by a sideways market which lasted almost 4 years. The longer a share remains in a sideways pattern the stronger and further it will rise once it breaks out of that market on the upside. So, in the case of Sasol, we were able to find an unbroken horizontal count of 13 using a box size of R23 and a 3-point reversal. Multiplying these three numbers together and adding the result to the lowest point in the sideways market (the support level of 360) we arrived at a target for Sasol of R1257 (R360 + (R23X3X13)). Horizontal counts in Point and Figure charting are about 70% accurate in our experience. We have a great lecture module on Point and Figure charting available at our online shop here - https://pdsnetshop.co.za/product/lecture-module-26-point-and-figure/ - Alternatively, please refer to lecture module 26 in our online course.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: