At the start of a new year, we always give our view of what we think is to come. Since our last article, published on 22nd December 2025, there have been some notable developments in the international arena which are potentially important for South African investors.

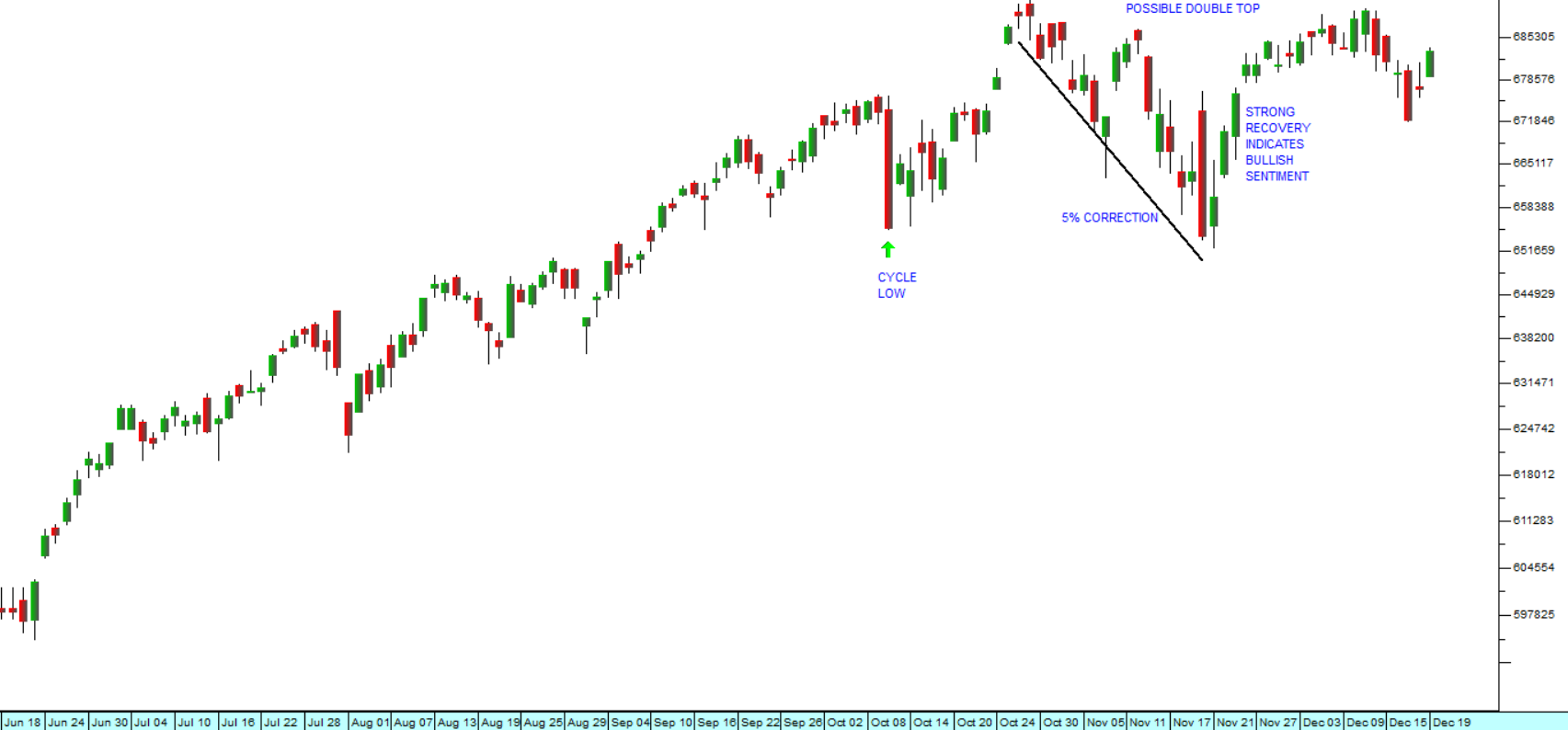

(1) As expected, the rand has strengthened further, continuing the trend of the last nine months and breaking convincingly below R16.50 to the US dollar. What is notable is that the rand has also strengthened against other hard currencies, like the euro and the British pound. We have long considered the rand to be under-valued and we expect it to continue strengthen, especially against the US dollar which has itself been weakening against other hard currencies. Consider the chart:

South African rand/US dollar : March 2025 - 9th of December 2026. Chart by ShareFriend Pro.

South African rand/US dollar : March 2025 - 9th of December 2026. Chart by ShareFriend Pro.

The rand broke below the key R17.50 level in September and then that level became a support level. But now it has moved down to R16.50 and looks set to stabilise at that level. The strengthening currency reflects a growing local and internation optimism about South Africa’s future.

(2) Gold and platinum continue to perform well bolstering South Africa’s economy and providing jobs for thousands of miners. Gold reached a new all-time record high on Friday last week closing above $4500 for the first time ever. I bought my first Krugerrand for R600 in 1985 and last week that same coin was worth a new record high value of R75 000. We reiterate our view that, because of the political risk in this country, South Africans should hold 10% of their total wealth in Krugerrands. Gold may correct from these levels on profit-taking, but the long-term trend will continue to be up – so make sure you have some of these internationally accepted, highly transportable assets in your portfolio.

(3) The unexpected invasion of Venezuela and the capture of Maduro marks a new direction for the Trump administration. The attack was executed with surgical precision and, while it sets a dangerous precedent, it has definitely boosted Trump’s dictatorial confidence. One effect is that he has suddenly become less afraid of Putin and has been willing to put in motion various measures which are good for Ukraine and bad for Russia. The first was capturing two oil tankers in Putin’s “shadow Fleet” and the second approving a Bill which will result in tariffs of up to 500% on any country which buys oil from Russia.

At the same time, the Ukrainians have been very effective in their management of the drone war, increasing their production of drones dramatically and innovating new technologies which have given them a definite edge over Russia. This can be seen in their recent use of a land drone, packed with 12 anti-tank mines, to completely wipe out an entire Russian stronghold.

We never expected the war in Ukraine to last as long as it has, mainly because we thought that, with Europe and America’s backing, Ukraine ultimately had far more resources at its disposal than Russia. We still believe firmly in Ukraine’s superiority, but this year we expect that advantage to finally force Putin to the negotiating table. The Russian economy is crumbling under sanctions; the Urals oil price has collapsed and Russia’s performance on the battlefield has been abysmal.

(4) The South African economy is definitely improving. There is, of course, still a great deal of room for further improvement and we remain light years away from being a first world country – but our economy is in far better shape than most third world or emerging market countries, especially most of those in Africa to the North and many of those in South America and Asia. The improvements can be traced back to the monetary discipline exercised by the Reserve Bank which has brought our inflation rate close to or even better than many first world countries. Low inflation has increased the level of real take-home pay and that, in turn, is impacting consumer spending. We expect the economy to continue improving this year, provided that there are no material external shocks. The Municipal elections towards the end of the year should be significant in consolidating our new direction.

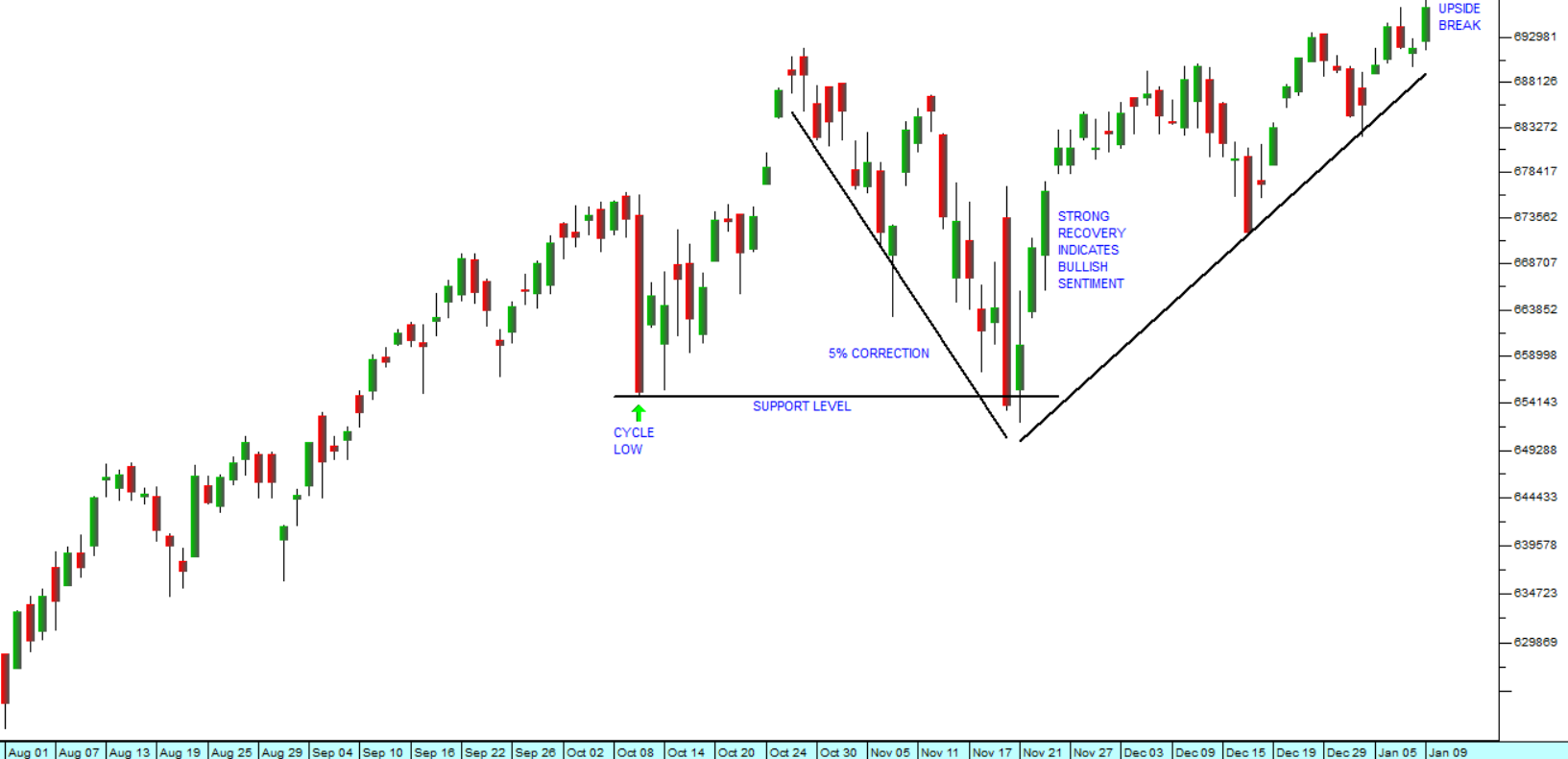

(5) The Great Bull Market, which began in March 2009, remains intact, with the S&P500 closing on Friday last week at another new all-time record high. The productivity impact of AI and the steady move towards solar and other alternative power sources is raising the performance and prospects of S&P500 companies. Consider the chart:

S&P500 Index : 1st August 2025 - 9th of January 2026. Chart by ShareFriend Pro.

S&P500 Index : 1st August 2025 - 9th of January 2026. Chart by ShareFriend Pro.

The stage is set for another strong year featuring rising profits stimulated by further advances in technology and lower oil prices.

As a private investor you should be close to fully invested in this market. Just make sure that you maintain a strict stop-loss strategy. Remember, being successful in the share market is not so much about making money as it is about not losing it.