ANAUME

6 May 2016 By PDSNETCandlestick formation. An exceptional exhaustion pattern (meaning "gap filling") composed of five candles. The anaume occurs when the gap is filled in after a market price has changed directions. This pattern coupled with the other patterns, indicates a strong potential for a bullish reversal and price advance.

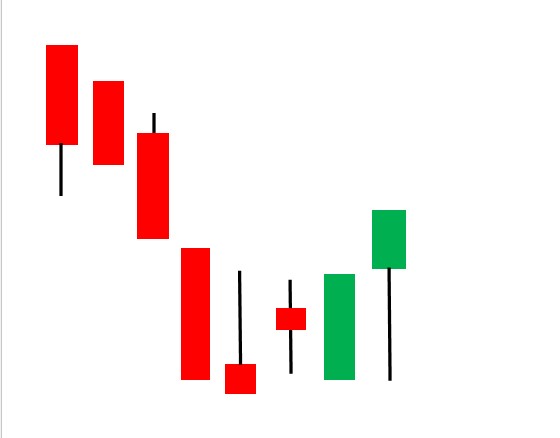

In this diagram, the anaume is the last five candles on the right-hand side. The anaume usually comes after a downtrend and is a 5-day period of backing and filling which culminates with the "gap filling" final candle which indicates that a new upward trend has begun.

Share this glossary term: