The Giant Awakens

17 May 2017 By PDSNETAs expected, Wall Street is making new highs on the back of a buoyant economy and record low unemployment. It is ignoring the bad news like weaker-than-expected housing and focusing on the bullish data like the 211 000 jobs created in April month. This is typical bull market behavior. In a bull market, investors focus on the positive and tend to ignore the negative.

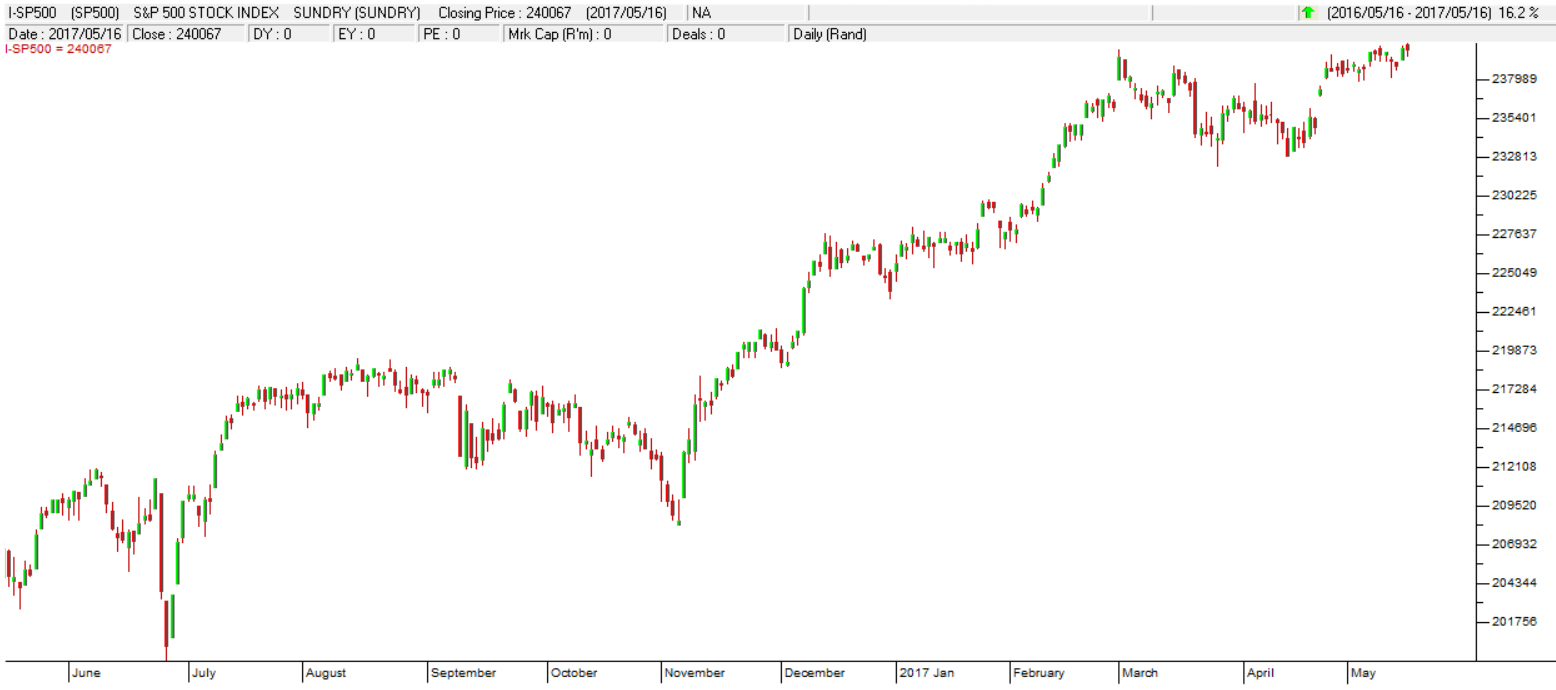

What is interesting is that market commentators and analysts appear to be continuously surprised by this succession of new highs. Before the current new high, many thought that Wall Street was over-priced and due for at least a correction, if not a new bear trend. It seems that they have forgotten that America and almost all first-world countries are just emerging from 8 years of unprecedented monetary stimulation. Has everyone forgotten that central bankers printed and injected more than $12 trillion into the world economy and that interest rates have been at record lows for nearly a decade? Economists and analysts are proceeding as if that massive quantitative easing and monetary stimulation is old history now, or that it never happened. Its longer term ramifications are never considered or commented on. Nobody is asking what the effects will be on the world economy or asset prices. Of course, the fall in the oil price has tended to obscure the inflationary effects of all this stimulation. And since 2008, consumers and businesses have been wary of spending, choosing to rather conserve cash in case there was a further recession. But the latest figures coming out of the US economy show that confidence is definitely returning. People and businesses are beginning to spend again. Unemployment is low and falling. It is estimated that the non-financial companies of the world are sitting on about $7 trillion in cash and near-cash. In South Africa alone, non-financial companies have about R600 billion in cash reserves. American companies are beginning to spend their cash pile and employing more people in the process. This is creating a consumer spending boom which is being reflected in higher profits and a rising share market. But we believe that the spending has only just begun. As confidence returns, spending will increase steadily. Confidence feeds on confidence. Eventually those American companies will not only spend the R7 trillion that they have, as their confidence grows, they will borrow five times as much and spend that too. In our view, the world is sitting on the cusp of a massive economic boom which is being reflected in rising share markets. Consider the chart of the S&P500 index over the past year:

S&P500 May 2016 to May 2017 - Chart by ShareFriend Pro

As you can see, it has just made yet another new high and the trend, interrupted by the inevitable corrections, is undoubtedly upward. The US dollar is weakening against most hard currencies and we expect that trend to continue and to be discounted into asset prices (like shares) and commodity prices (like gold and platinum). The American's have significantly debased their currency, inevitably, that must be reflected in a period of currency weakness and rising asset prices. As a private investor, this means that you should own those assets which are likely to benefit from rising prices, like shares. As night follows day, the JSE will, sooner or later, follow Wall Street up.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: