Exploiting October Fear

11 October 2018 By PDSNETEver since the collapse of Wall Street in October 1929, October month has been a time of fear and nervousness for investors. That fear was compounded by the single day 23% drop in the S&P500 index in October 1987. So every October, investors, especially in America, worry about a possible melt-down in the share market. And, of course, some of them decide to sell out just in case there is such a crash. Those sell-outs tend to make October a volatile and scary month.

Last night’s 3,29% fall on Wall Street was a result of just such fear-based selling. Two factors caused the sell-off. One was the fear of interest rates rising more quickly than was previously expected. This is directly attributable to the strength of the US economy. Whenever there is a spate of very positive economic news, investors get scared that the Federal Reserve Bank will raise interest rates more aggressively – and ironically this causes shares to fall.

However, in our experience this is usually overtaken by the solid performance of the economy and investors realise that the improved economic conditions will lead to rising profits among the S&P500 companies and that results in rising share prices. The second factor is the correction in tech shares. These shares have been driving the bull trend on Wall Street – mainly because of their exceptional profits and the expectation that their profits will continue to be excellent and even get better. The result of this is that the Nasdaq index – which is associated with tech shares in America – has been breaking new record highs for some time – and dragging the rest of the market up with it.

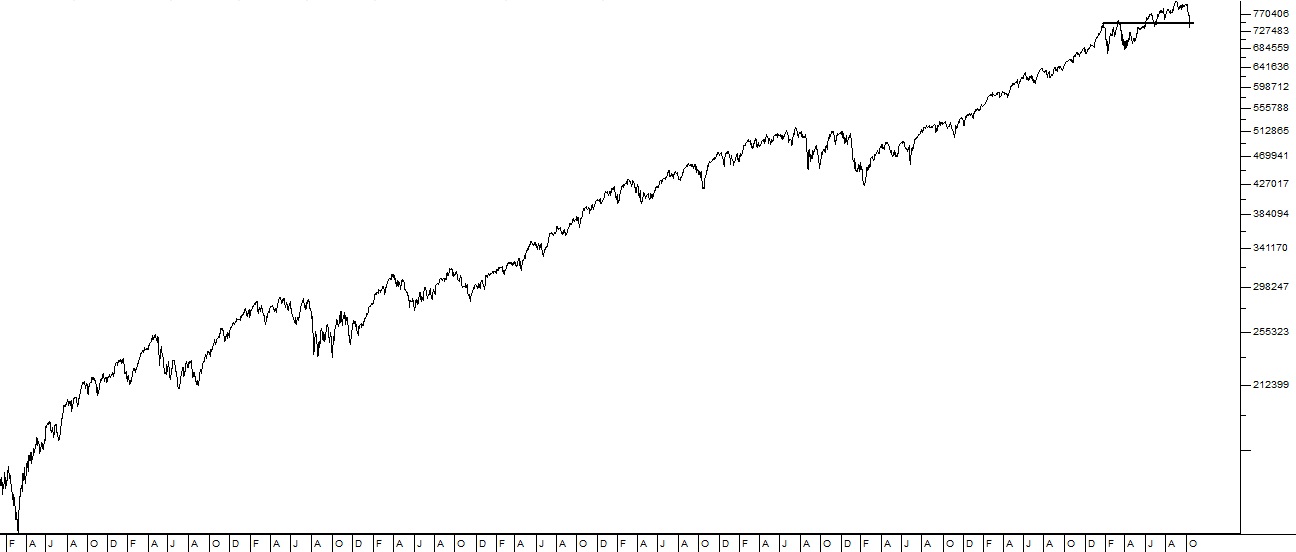

Now the Nasdaq is correcting. In the last seven days it has fallen by 7,6%. That should be seen against its 84,3% rise since March 2009 – when this bull market started. This correction is probably healthy and overdue – and it is smaller than at least three previous corrections in the Nasdaq during that time. Consider the semi-log chart of the Nasdaq over the past ten years:

Nasdaq Composite Index October 2008 to October 2018 - Chart by ShareFriend Pro

Undoubtedly, last night’s fall will impact markets around the world today, including the JSE. In our view, despite the fact that we are in the middle of October, this is not the start of a bear trend. We see it as a correction – mainly because the powerful growth of the US economy remains in place. Soon enough, positive statistics emerging from that economy will cause investor sentiment to turn and the bargain hunting will begin. In the meantime, you have to decide what you as a private investor in South Africa should do about the situation. We believe that this is a buying opportunity. So you should look for high-quality shares which are trading at very good prices and use the opportunity to buy into them or to increase your holdings and average down at lower levels. Consider the 8-month chart of the S&P500:

S&P500 Index January to October 2018 - Chart by ShareFriend Pro

Here you can see the previous record high of 2872 (the horizontal blue line) which was exceeded less than a month ago on 27th August 2018. For us to become concerned that the S&P was moving into a bear trend, it would need to break below the low made on 7th February 2018 and tested on 2nd April 2018 at 2581. We do not see that happening. There will probably be some “backing and filling” at current levels on the S&P, and you will need to choose your exact moment to buy in, but, sooner or later, the bull trend will continue and a new record high will be achieved. Once October is behind us, we will almost certainly see a strong recovery in the S&P.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: