Cartrack

30 April 2018 By PDSNETOne of the most interesting smaller shares on the JSE is Cartrack (CTK). This company specialises in the vehicle security business and has operations all over the world. Its client base is growing steadily as more and more people seek to secure their vehicles cheaply using modern tracking technology. In the year to February the company increased its subscription revenue by 19% to R1,2 billion. The company has an amazing operating margin of 33% which translates into headline earnings of more than 100c per share.

But the real point about Cartrack is that it is the perfect service company with a technology that is limited only by the number of vehicles on the roads of the world. It has no debtors, stock or capital tied up in plant and machinery. It basically has negative working capital, because it can still run its creditors out to 30, 60 or 90 days. It has no massive staff of semi-skilled or unskilled workers – so it has no union exposure.

Such a company receives most of its income by way of an established debit order off its clients’ bank accounts. It is already in profit before the month begins and any additional business it brings in goes directly to the bottom line.

In many ways it is the ultimate tech share. Its assets get into their cars at night and go home. The capital risk is very low – because it has very little capital tied up in the business. Compare this to the average company which has union exposure, substantial capital invested in plant, machinery and property plus a burgeoning working capital position consisting of huge stock and debtors books and you will see that it is a management and an investor’s dream come true.

From a technical point of view, the company is really too small to be an “institutional share” with about R1,5m worth of shares changing hands each day on average over the past three months. Form a private investor’s perspective, this means that it is very easy to get into and out of, but it also means that the big institutions are not taking a serious interest in it yet. For example, on Thursday (26-4-18) 65 000 shares changed hands worth just over R1,2m.

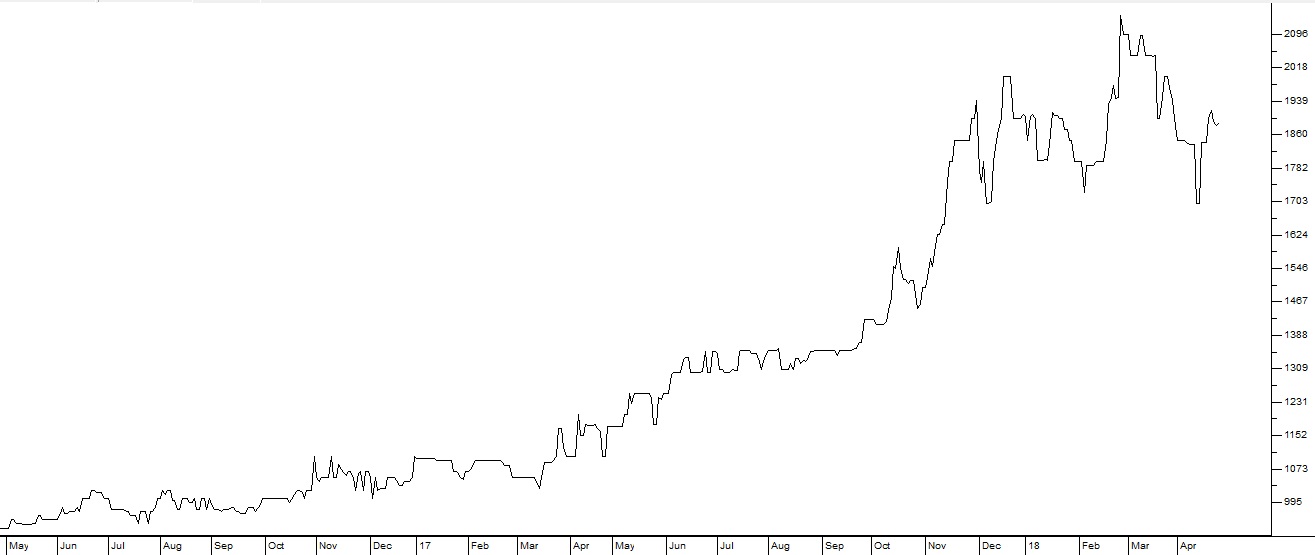

We suggest that this is a company that is evidently well-managed, making good profits and steadily growing its market organically world-wide. It is a service company with a winning technology and it has almost unlimited “blue sky” potential. Right now it is trading on an historical P:E of 19 – which is exactly in line with the average P:E of the JSE Overall index. We believe that it deserves, and will sooner or later command, a much higher rating. Consider the chart over the past two years:

Cartrack (CTK) May 2016 to April 2018 - Chart by ShareFriend Pro

The slightly boxy shape of this chart, especially a year ago, reflects the relatively thin volumes traded.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: