The JSE�s Island Formation

4 July 2017 By PDSNETWith all the turbulence on the South African political scene it has been difficult to discern the direction of the JSE over the past year. The JSE Overall index has moved sideways while the markets of the world, and especially Wall Street have been making new highs.

Consider the chart:

JSE Overall Index October 2016 to July 2017 - Chart by ShareFriend Pro

The optimism of March, April and the first half of May suddenly gave way to renewed negativity, probably because the Minister of Mineral Resources published a ridiculous third version of the mining charter which has driven investors away from South Africa and wiped about R51bn off our resource shares. That took the JSE Overall index all the way back to its previous support level at about 50800. At that level there has been considerable support resulting in what technicians call an "island formation". An island usually occurs after a steep fall resolves itself into a period of backing and filling until the uncertainty and fear is driven out of the market by bargain hunters, then there is a strong recovery as investors pile back into shares at the lower levels. The JSE Overall's island was broken convincingly yesterday (Monday 3rd July) when it made a strong positive candle. In the previous article we suggested that the JSE was due to do some catching up with other world markets and that it was relatively under-priced at current levels. It seems likely that the S&P500 index will make a new record high now that the U.S. Independence Day holiday is over. The S&P looks quite ready for an upside breakout following the recent correction:

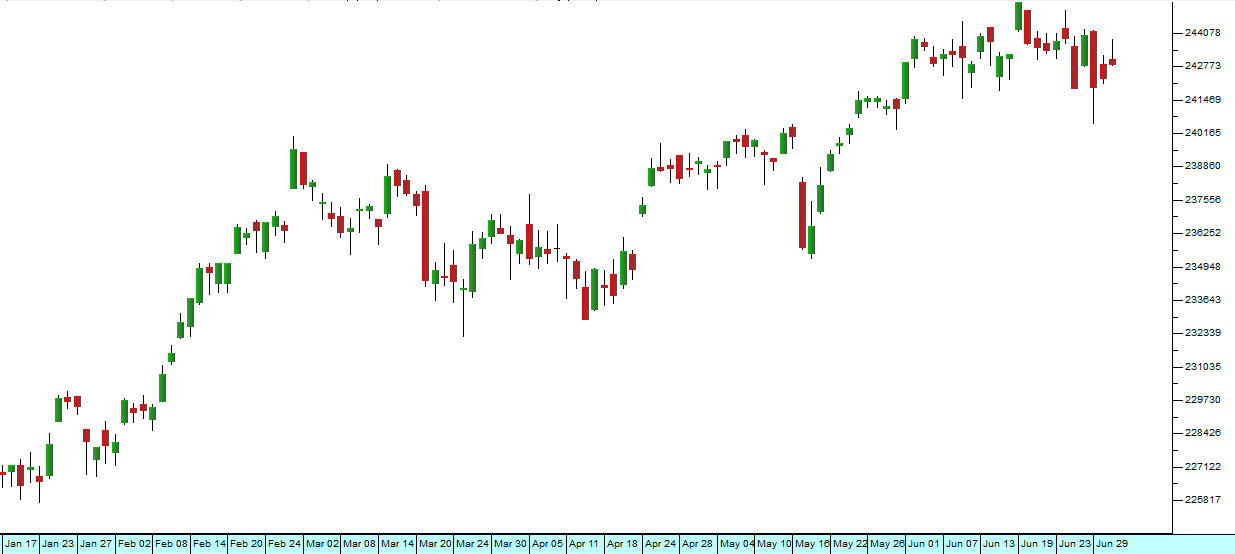

S&P500 Index January 2017 to June 2017 - Chart by ShareFriend Pro

You should be positioned to take advantage.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: