Market Overview

25 July 2017 By PDSNETOver the past few weeks there have been a number of interesting developments. There have been more revelations coming out of the leaked Gupta e-mails which show just how far state capture has gone, but as yet there is no action from the government or even an official position on this matter. It is as if their attitude is that if they ignore it for long enough it will disappear. The Zuma camp is struggling to progress any of their radical populist agendas because of strong opposition from within the ANC and without.

The political dilemma is best evaluated by watching the progress of the rand against the US dollar:

Rand Dollar - Chart by ShareFriend Pro

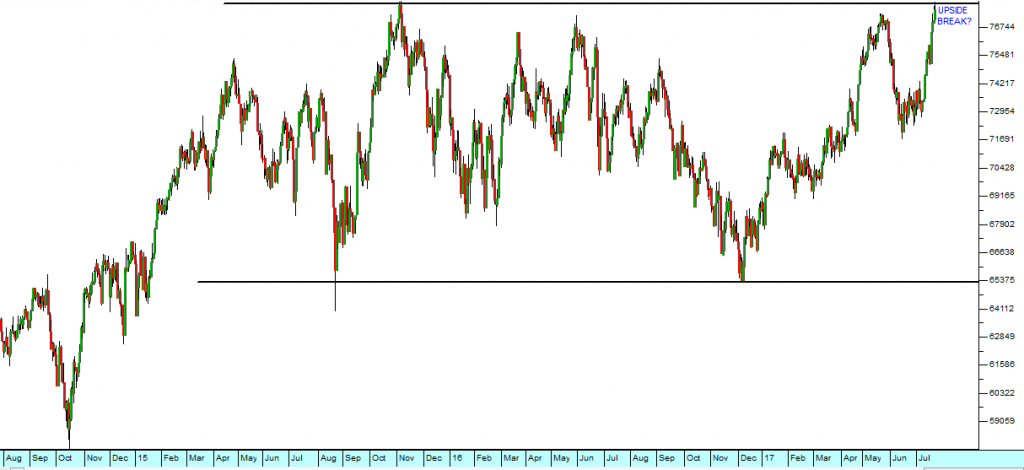

The above chart shows that the effect of the political turmoil in South Africa has been to temporarily arrest the strengthening trend in the rand rather than to halt it. The international currency traders who dominate this market appear to be positive about the long-term outcome, which can only meanthat they see positive regime change in the not-too-distant future. It is almost as if the Zuma camp, like the Trump camp, is becoming less and less relevant to the progress of the economy and the markets. It is as if the forces which are now playing out, and which were set in motion long before the current political incumbents came into office, are linked together and are set to play themselves out more-or-less irrespective of the shenanigans of the current unfortunate leadership. The JSE is showing clear signs of following other world markets into new record territory. The JSE Financial and Industrial index, which has been trapped in a sideways market for more than two years looks ready to break upwards. Consider the chart:

JSE Overall Index - Chart by ShareFriend Pro

A strong upside break would herald further gains and perhaps a"catching up" with other world markets. We have seen an increasing number of new listings which suggests that we may be heading into some sort of listings boom. Most notable among these are:

- Dischem, which we have written about in previous articles:

Dischem Pharmacies (DCP) - Chart by ShareFriend Pro

- And Long 4 Life, which we have written about in a previous article:

Long 4 Life (L4L) - Chart by ShareFriend Pro

Both are doing very well and show promise of continued steady growth. Underlying these developments is a steady rise in the S&P500 index which has made a series of new record highs. We believe that the S&P will continue to perform well, driven mainly by improving corporate profits in an economy that is now growing strongly as confidence levels return and consumers and businesses begin spending some of the cash they have been hoarding since the sub-prime crisis in 2007/8. Consider the chart:

S&P500 Index - Chart by ShareFriend Pro

Here you can see the S&P500 index climbing steadily between its two long-term channel lines. This index is driving the progress of all markets around the world, including the JSE. It is approaching its upper channel line, which implies that some sort of pull-back or correction may be imminent. You should bear that in mind, as an investor and recognise it, when it happens, for what it is - a healthy correction in a powerful long-term bull trend.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: